Stock Market Outlook for July 12, 2021

While Friday’s bounce was encouraging, it continues to look like the market is stalling at current heights.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Capital Power Corp. (TSE:CPX.TO) Seasonal Chart

Motorola Solutions Inc. (NYSE:MSI) Seasonal Chart

Donaldson Co, Inc. (NYSE:DCI) Seasonal Chart

WisdomTree Earnings 500 Fund (NYSE:EPS) Seasonal Chart

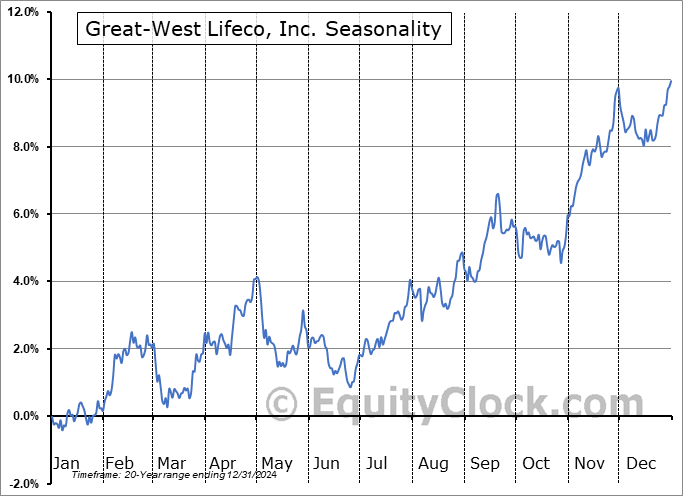

Great-West Lifeco, Inc. (TSE:GWO.TO) Seasonal Chart

Radian Group, Inc. (NYSE:RDN) Seasonal Chart

ZYNEX Inc. (NASD:ZYXI) Seasonal Chart

Invesco Dividend Achievers ETF (NASD:PFM) Seasonal Chart

Â

Â

The Markets

Stocks rebounded from Thursday’s shock decline as money that had ploughed into bonds in recent days flowed back towards stocks to end the week. The S&P 500 Index closed with a gain of 1.13%, erasing the prior session’s loss. Support at the 20-day moving average, which was tested on Thursday, continues to provide short-term support. Momentum indicators, which had been showing clear signs of rolling over just one session ago, saw a reprieve, although the evidence of a curling peak remains. This is still a market that is on an intermediate-term trend of higher-highs and higher-lows, but the technicals in recent days and weeks have gotten us concerned enough to step back from our 100% exposure to stocks. We are waiting for a better opportunity to be fully invested again.

Today, in our Market Outlook to subscribers, we discuss the following:

- Jittery short-term trading action on the hourly chart of the large-cap benchmark

- The stalling of the rising trends of a number of equity benchmarks

- Expectation of a standard and normal correction of 5% to 10%

- Canada Labour Force Survey and the Canadian Dollar

- US Wholesale Inventories and Sales

Subscribe now and we’ll send this outlook to you.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.87.

Â

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|