Stock Market Outlook for July 21, 2021

Did Tuesday’s rally really change anything? We discuss in today’s report.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Leidos Holdings, Inc. (NYSE:LDOS) Seasonal Chart

Sensient Technologies Corp. (NYSE:SXT) Seasonal Chart

Harmonic, Inc. (NASD:HLIT) Seasonal Chart

SkyWest, Inc. (NASD:SKYW) Seasonal Chart

First National Financial Corp. (TSE:FN.TO) Seasonal Chart

iShares U.S. IG Corporate Bond Index ETF (CAD-Hedged) (TSE:XIG.TO) Seasonal Chart

First Asset Canbanc Income Class ETF (TSE:CIC.TO) Seasonal Chart

Â

Â

The Markets

Stocks snapped back on Tuesday as the buy-the-dip crowd stepped in to pick up beaten down segments of the market following recent declines. The S&P 500 Index recouped 1.52%, essentially erasing the decline recorded in the previous session and closing the downside gap that was opened to start the week. Support at the 50-day moving average, which was under threat in the Monday session, continues to support the intermediate-term trend of higher-highs and higher-lows. The onslaught of earnings to be released in the days ahead is unlikely to entice investors from taking any aggressive bets, either positive or negative, until the results are released. The market has moved beyond the average summer rally period and into a period of average volatility. This period often creates effective buying opportunities to load up on desired allocations ahead of the fall.

Today, in our Market Outlook to subscribers, we discuss the following:

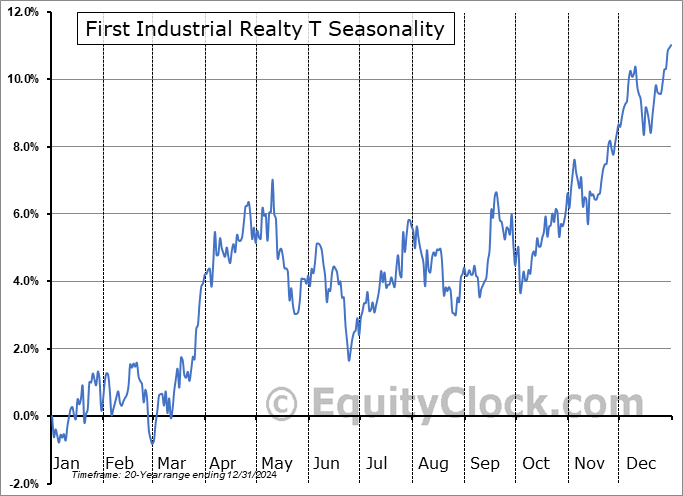

- The REIT sector

- Range-bound trends for broad market benchmarks

- Credit conditions

- Copper/Gold ratio and what it says about whether to be risk-on or risk-off

- US Housing Starts and home construction stocks

Subscribe now and we’ll send this outlook to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.78.

Â

Â

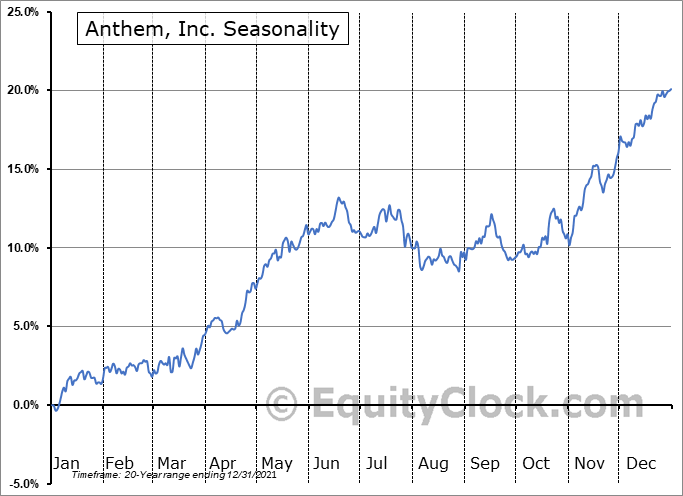

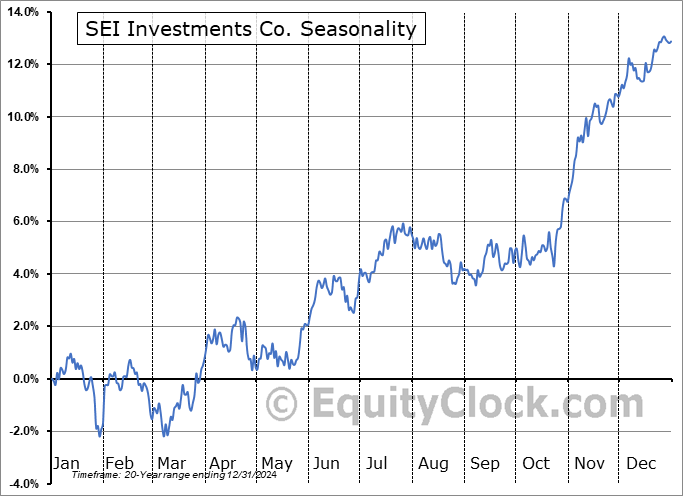

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|