Stock Market Outlook for July 23, 2021

The inventory of homes for sale is starting to improve, allowing existing home sales to emerge from a multi-month slump of below average activity.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Umpqua Holdings Corp. (NASD:UMPQ) Seasonal Chart

First Midwest Bancorp, Inc. (NASD:FMBI) Seasonal Chart

Northwest Bancshares, Inc. (NASD:NWBI) Seasonal Chart

Marlin Business Services Corp. (NASD:MRLN) Seasonal Chart

ProShares UltraShort MSCI EAFE (NYSE:EFU) Seasonal Chart

Purpose High Interest Savings ETF (TSE:PSA.TO) Seasonal Chart

SPDR Barclays 1-3 Month T-Bill ETF (NYSE:BIL) Seasonal Chart

Vanguard Intermediate-Term Bond ETF (NYSE:BIV) Seasonal Chart

Vanguard Total Bond Market ETF (NASD:BND) Seasonal Chart

ProShares Short Dow30 (NYSE:DOG) Seasonal Chart

iShares Intermediate-Term Corporate Bond ETF (NASD:IGIB) Seasonal Chart

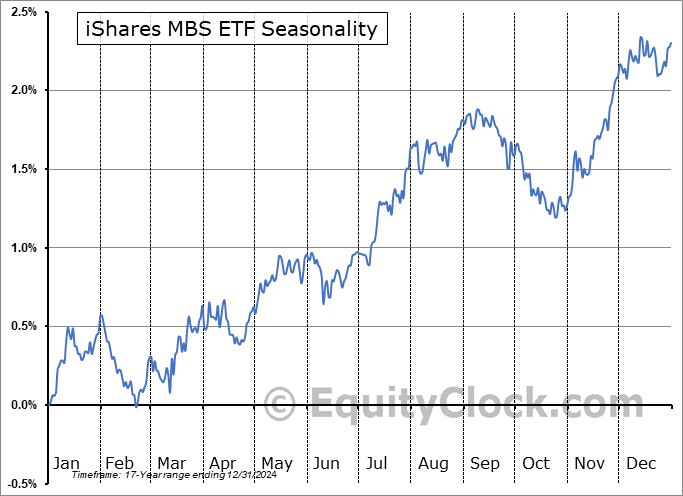

iShares MBS ETF (NASD:MBB) Seasonal Chart

ProShares UltraShort S&P500 (NYSE:SDS) Seasonal Chart

ProShares UltraShort Industrials (NYSE:SIJ) Seasonal Chart

ProShares UltraShort Basic Materials (NYSE:SMN) Seasonal Chart

Â

Â

Â

The Markets

Stocks drifted slightly higher on Thursday as investors continue to digest a flood of earnings reports. The S&P 500 Index closed with a gain of two-tenths of one percent, continuing to retake levels above short-term support at the rising 20-day moving average. Intermediate support remains intact at the rising 50-day moving average.Â

Today, in our Market Outlook to subscribers, we discuss the following:

- The short-term trend of the market at risk of falling into a path of lower-lows and lower-highs

- Jobless claims and the maturing of the strength in the labor market

- Natural gas inventories and the fundamental backdrop to the commodity

- US Existing Home Sales and the homebuilders ETF

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.87.

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|