Stock Market Outlook for September 24, 2021

Another week remains in the period of peak volatility for stocks, but we are starting to see some enticing setups that fulfill the technical and fundamental requirements that our strategy encompasses now.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Walt Disney Co. (NYSE:DIS) Seasonal Chart

Wells Fargo & Co. (NYSE:WFC) Seasonal Chart

Sonoco Products Co. (NYSE:SON) Seasonal Chart

BMO Equal Weight U.S. Banks Hedged to CAD Index ETF (TSE:ZUB.TO) Seasonal Chart

Korn Ferry Intl (NYSE:KFY) Seasonal Chart

Marcus Corp. (NYSE:MCS) Seasonal Chart

Check Point Software Technologies, Ltd. (NASD:CHKP) Seasonal Chart

UBS AG (NYSE:UBS) Seasonal Chart

Apple Hospitality REIT, Inc. (NYSE:APLE) Seasonal Chart

Invesco Aerospace & Defense ETF (NYSE:PPA) Seasonal Chart

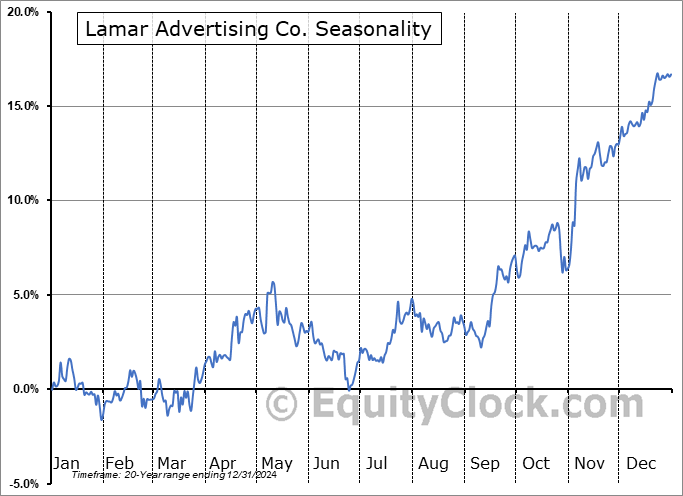

Lamar Advertising Co. (NASD:LAMR) Seasonal Chart

Werner Enterprises, Inc. (NASD:WERN) Seasonal Chart

H&E Equipment Services Inc. (NASD:HEES) Seasonal Chart

Nuance Communications, Inc. (NASD:NUAN) Seasonal Chart

Â

Â

The Markets

Stocks continued to snap-back from early week losses on Thursday, quickly flipping the return on the week from red to green. The S&P 500 Index rallied by 1.21%, closing the gap that was opened on Monday and moving back above the 50-day moving average line that was broken last week. Previous trend channel support, as well as the 20-day moving average, remains in a position of resistance. The benchmark has maintained support at the 100-day moving average. Another week remains in the period of peak volatility for stocks, but while the calendar suggests that it remains prudent to continue to sit with a neutral allocation to stocks, we are starting to see some enticing setups that fulfill the technical and fundamental requirements that our strategy encompasses.

Today, in our Market Outlook to subscribers, we discuss the following:

- A look at how the trend of COVID cases is evolving compared to the seasonal norm as we head into respiratory illness season and the equity plays to benefit from this recent path

- Weekly Jobless Claims and the health of the labor market

- Natural Gas inventories and our view of the commodity

- Natural Gas stocks

- Canadian Retail Trade: What is driving activity and how we desire to focus our portfolio to take advantage of the themes this fall

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.79.

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|