Stock Market Outlook for November 19, 2021

The rise in COVID cases is causing a stir in the market. Read our thoughts in today’s report.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Allegheny Technologies (NYSE:ATI) Seasonal Chart

La Z Boy, Inc. (NYSE:LZB) Seasonal Chart

Duke Realty Corp. (NYSE:DRE) Seasonal Chart

Mohawk Inds, Inc. (NYSE:MHK) Seasonal Chart

Total Energy Services Inc. (TSE:TOT.TO) Seasonal Chart

American Axle & Manufac. (NYSE:AXL) Seasonal Chart

Yamana Gold Inc. (NYSE:AUY) Seasonal Chart

Booking Holdings Inc. (NASD:BKNG) Seasonal Chart

iShares Global Industrials ETF (NYSE:EXI) Seasonal Chart

iShares Core S&P Small-Cap ETF (NYSE:IJR) Seasonal Chart

Vanguard Real Estate ETF (NYSE:VNQ) Seasonal Chart

Advanced Micro Devices, Inc. (NASD:AMD) Seasonal Chart

KB Home (NYSE:KBH) Seasonal Chart

Keycorp (NYSE:KEY) Seasonal Chart

iShares U.S. Real Estate ETF (NYSE:IYR) Seasonal Chart

Sealed Air Corp New (NYSE:SEE) Seasonal Chart

First Quantum Minerals Ltd. (TSE:FM.TO) Seasonal Chart

National Oilwell Varco, Inc. (NYSE:NOV) Seasonal Chart

Wheaton Precious Metals Corp. (NYSE:WPM) Seasonal Chart

Teck Resources Ltd. (TSE:TECK/B.TO) Seasonal Chart

M/I Homes, Inc. (NYSE:MHO) Seasonal Chart

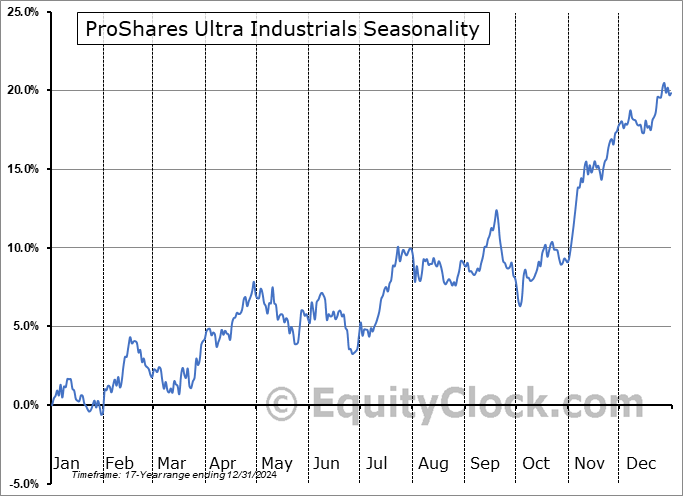

ProShares Ultra Industrials (NYSE:UXI) Seasonal Chart

Enphase Energy Inc. (NASD:ENPH) Seasonal Chart

iShares U.S. Financials ETF (NYSE:IYF) Seasonal Chart

Invesco Solar ETF (NYSE:TAN) Seasonal Chart

SPDR S&P Metals and Mining ETF (NYSE:XME) Seasonal Chart

Real Estate Select Sector SPDR Fund (NYSE:XLRE) Seasonal Chart

Â

Â

The Markets

Stocks closed mixed on Thursday as investors rotated back to growth stocks amidst concerns pertaining to the latest rise in COVID cases around the globe. The S&P 500 Index added just over a third of one percent, reaching back towards the all-time high charted in the first week of November above 4700. Short-term support at the 20-day moving average has edged higher to 4643, while intermediate support at the rising 50-day moving average can be pegged at just above 4500. The trends across short, intermediate, and long-term timeframes remain positive.

Today, in our Market Outlook to subscribers, we discuss the following:

- The rise in COVID cases globally and what seasonal tendencies suggest for the path of the virus ahead

- The impact from rising concerns pertaining to the spread of the virus and the breakout in growth relative to value

- S&P 500 Index performance during the week of US Thanksgiving

- Shipping activity and the recent plunge of the Baltic Dry Index from multi-year highs

- The seasonal trade in the transportation sector

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.69.

Â

Â

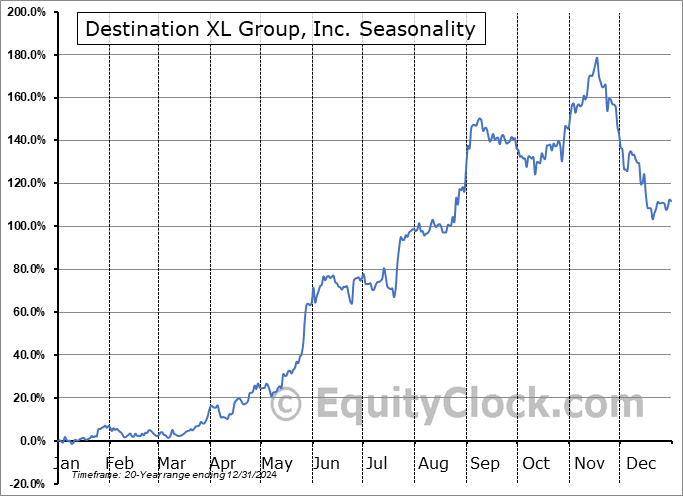

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|