Stock Market Outlook for February 8, 2022

Extremes, such as this, can typically take weeks to unwind.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

GlaxoSmithKline plc (NYSE:GSK) Seasonal Chart

Gartner Group, Inc. (NYSE:IT) Seasonal Chart

NuVasive, Inc. (NASD:NUVA) Seasonal Chart

Companias Cervecerias (NYSE:CCU) Seasonal Chart

iShares MSCI All Country Asia ex Japan ETF (NASD:AAXJ) Seasonal Chart

iShares MSCI Eurozone ETF (NYSE:EZU) Seasonal Chart

Vanguard FTSE Europe ETF (NYSE:VGK) Seasonal Chart

Tech Achievers Growth & Income Fund (TSE:HTA.TO) Seasonal Chart

The Markets

Stocks gave up earlier gains on Monday to end the session in the red as selling pressures in the technology sector once again had a substantial impact on broad market benchmarks. The S&P 500 Index closed down by nearly four-tenths of one percent, remaining pinned just below its declining 20-day moving average. Support can continue to be pegged at the rising 200-day moving average, now at 4,445. Momentum indicators are still pointing higher following the rebound from the lows charted in the last week of January, however, characteristics of a bearish trend can still be seen with MACD and RSI below their middle lines. The equity market still appears to be under a lot of stress here as investors aggressively take down their allocations to the formerly loved growth trade (technology, consumer discretionary, communications services). With the period of seasonal weakness for Technology running into the month of April, we have little desire to be overly long growth either and we can look to pick up some of these beaten down names sometime in the spring.

Today, in our Market Outlook to subscribers, we discuss the following:

- The unwind of the extremes observed at the end of January

- Ratings changes in this week’s chart books: Find out what has been upgraded to Accumulate this week.

Subscribe now and we’ll send this outlook to you.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Updates Complete

In the month of January, we were busy updating all of the seasonal profiles in the chart database to reflect the data from the most recent calendar year. We are pleased to announce that this work has been completed and the spreadsheet available to yearly subscribers has also been updated. Yearly subscribers can navigate to the download link in the database to pull up the updated spreadsheet that allows members to filter through the results of the database from the comfort of their desktop.

Sentiment on Monday, as gauged by the put-call ratio, ended close to neutral at 0.94.

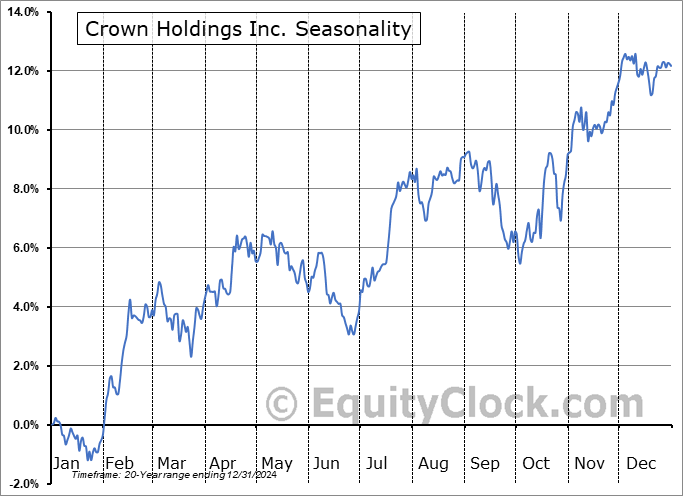

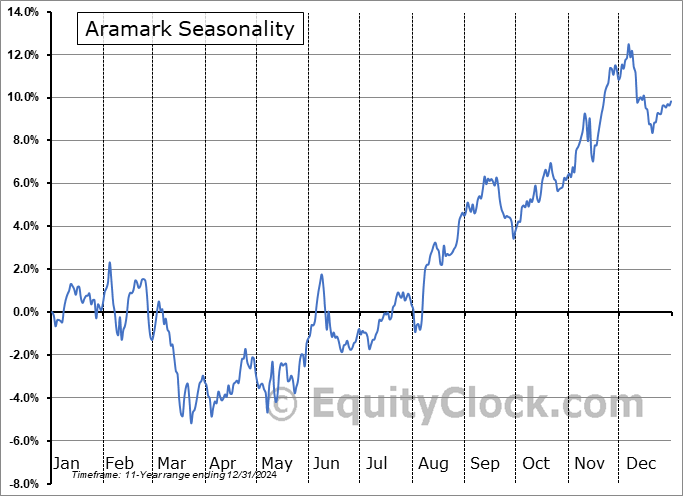

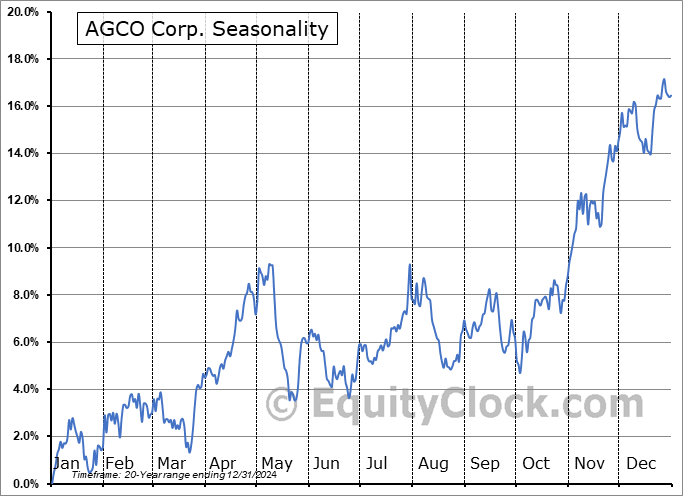

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|