Stock Market Outlook for July 19, 2022

Ethereum breaking out of its recent consolidation range, while Bitcoin remains stuck. Until each break back above levels of previous weekly support, now resistance, we remain Neutral on both.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

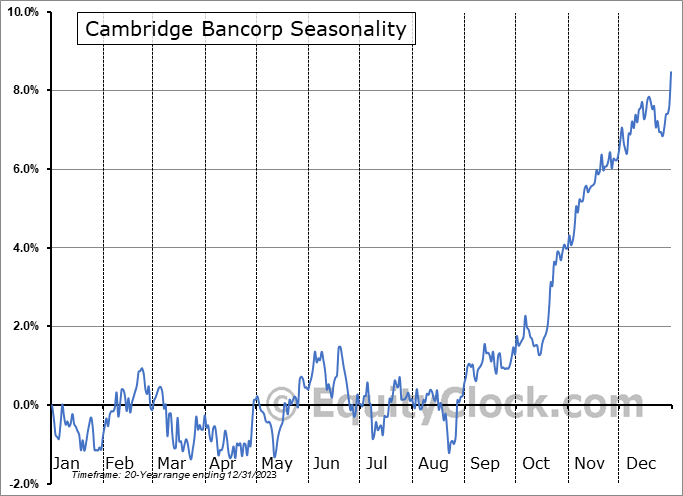

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Aflac, Inc. (NYSE:AFL) Seasonal Chart

Glacier Bancorp, Inc. (NASD:GBCI) Seasonal Chart

Invesco DB Precious Metals Fund (NYSE:DBP) Seasonal Chart

The Markets

Stocks slipped on Monday following headlines that tech-titan Apple will be pulling back on hiring and spending next year in response to slowing consumer momentum. The S&P 500 Index closed down by just over eight-tenths of one percent, reversing again from declining trendline resistance that has capped each upside attempt over the past few months. Momentum indicators continue to show characteristics of a bearish trend and the more intermediate-term trend of lower-lows and lower-highs remains stubbornly embedded. The appearance of a bear-flag pattern derived by the sharp plunge in June and the recent consolidation around the lows continues to be considered, which, if fulfilled, would imply a downside resolution to come before our next shot at the upside is seen.

Today, in our Market Outlook to subscribers, we discuss the following:

- Ethereum and Bitcoin

- The Volatility Index (VIX)

- US Dollar

- Ratings changes in this week’s chart books

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 19

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended slightly bearish at 1.04.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|