Stock Market Outlook for August 30, 2022

Price of Coffee is breaking out within its optimal seasonal holding period.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Invesco S&P SmallCap Low Volatility ETF (AMEX:XSLV) Seasonal Chart

Goldman Sachs ActiveBeta Japan Equity ETF (AMEX:GSJY) Seasonal Chart

Pacer US Cash Cows 100 ETF (AMEX:COWZ) Seasonal Chart

Bath & Body Works, Inc. (NYSE:BBWI) Seasonal Chart

iShares S&P Global Industrials Index ETF (CAD-Hedged) (TSE:XGI.TO) Seasonal Chart

Deep Value ETF (AMEX:DEEP) Seasonal Chart

Goodyear Tire & Rubber Co. (NASD:GT) Seasonal Chart

Vanguard Dividend Appreciation ETF (NYSE:VIG) Seasonal Chart

iShares Core Dividend Growth ETF (AMEX:DGRO) Seasonal Chart

The Markets

Stocks closed lower on Monday following massive market selloff that was realized in the week prior. The S&P 500 Index closed down by two-thirds of one percent after reaching down to levels around support at the rising 50-day moving average just above 4000. This intermediate hurdle had been suggested as a zone that could entice traders to step in to take advantage of the apparent shift of the intermediate trend. Levels down to the June lows are still fair game, but should the market accept a floor at this important hurdle, it would be difficult to be cautious of stocks given the re-adoption of a trend of higher-highs and higher-lows. The end of the month/start of new month could throw off some false signals amidst the end of period portfolio rebalancing, therefore best to tread cautiously. Momentum indicators relinquished characteristics of a bearish trend in the month of July as the market attempts to stabilize following the significant weakness recorded through the first half of the year.

Today, in our Market Outlook to subscribers, we discuss the following:

- Notable downgrades in this week’s chart books

- Coffee

- Energy sector industries

- Investor sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 30

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Soon to be released…

We are busy putting the final touches on the monthly report for September, providing you with all of the insight that you need to know for the month(s) ahead. Subscribers can look for this report in their inbox in the days ahead.

Not subscribed and want receive this report? Signup now to receive this and all of the insight an analysis that we provide to subscribers.

Sentiment on Monday, as gauged by the put-call ratio, ended overly bearish at 1.21.

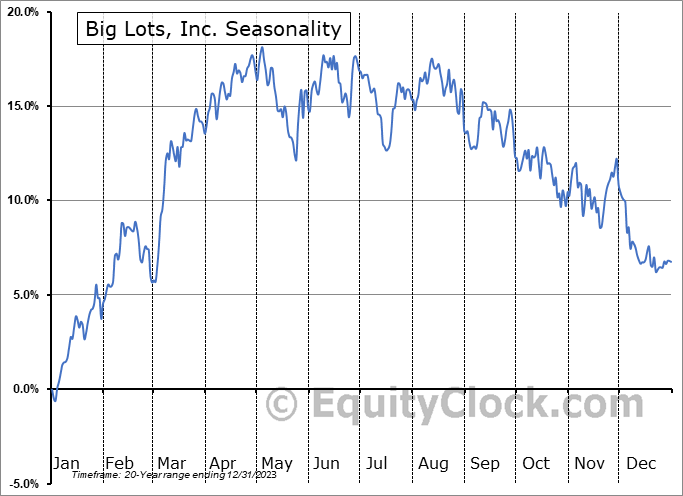

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|