Stock Market Outlook for October 26, 2022

Tuesday’s “dash for trash” had the riskiest, most beaten down segments of the market rally the most, an indication that the bears are becoming concerned of a more substantial bottoming pattern for stocks at hand.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

SPDR S&P Health Care Equipment ETF (NYSE:XHE) Seasonal Chart

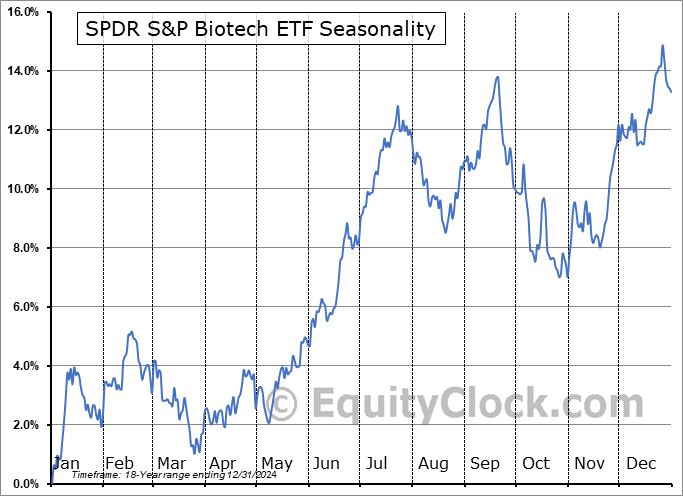

SPDR S&P Biotech ETF (NYSE:XBI) Seasonal Chart

iShares Russell Mid-Cap Growth ETF (NYSE:IWP) Seasonal Chart

iShares U.S. Healthcare Providers ETF (NYSE:IHF) Seasonal Chart

Amcor plc (NYSE:AMCR) Seasonal Chart

Cisco Systems, Inc. (NASD:CSCO) Seasonal Chart

Radware Ltd. (NASD:RDWR) Seasonal Chart

Align Technology, Inc. (NASD:ALGN) Seasonal Chart

The Markets

Stocks rallied on Tuesday as the ongoing reprieve in the rising trend of yields and the dollar gives lift to stocks. The S&P 500 Index gained 1.63%, instantly converging back on our forecasted target of the declining 50-day moving average that now hovers at 3868. The level will place the intermediate trajectory of the market to the test, either confirming the prevailing negative path that the benchmark has been in all year or suggest a more substantial rebound and bottoming pattern that is underway. A negative reaction will warrant taking measures to become more conservative in portfolio positioning. Previous short-term resistance at 3800 has been violated, breaking the short-term path of lower-lows and lower-highs and the 20-day moving average, which is now curling higher, is in a position of support. Positive momentum divergences versus price remain intact, something that initially alerted us to the waning selling pressures in the market through the first half of the month.

Today, in our Market Outlook to subscribers, we discuss the following:

- Tuesday’s “Dash for Trash”

- Mid-term and Pre-election year tendencies for stocks

- US Home Prices

- The test of support for treasury yields and the US Dollar

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 26

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bullish at 0.90.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|