Stock Market Outlook for November 3, 2022

Short-term rising trend of the S&P 500 Index stemming from the mid-October low has been broken.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

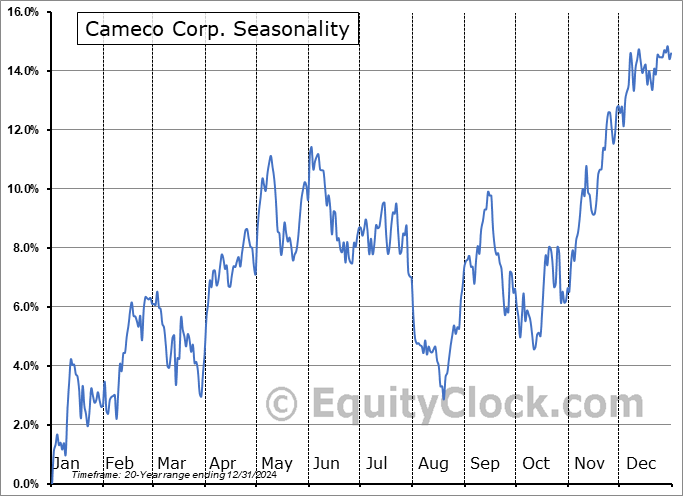

Cameco Corp. (TSE:CCO.TO) Seasonal Chart

CIT Group Inc. (NYSE:CIT) Seasonal Chart

Motorcar Parts of America Inc. (NASD:MPAA) Seasonal Chart

Marinemax, Inc. (NYSE:HZO) Seasonal Chart

Ritchie Bros. Auctioneers Inc. (TSE:RBA.TO) Seasonal Chart

Cargojet Inc. (TSE:CJT.TO) Seasonal Chart

Oshkosh Corp. (NYSE:OSK) Seasonal Chart

Yamana Gold Inc. (TSE:YRI.TO) Seasonal Chart

CI Financial Corp. (TSE:CIX.TO) Seasonal Chart

The Markets

Stocks flipped sharply lower on Wednesday as the market interpreted the comments from Fed Chair Powell following the latest FOMC meeting as being hawkish and that the Fed is still positioned to aggressively fight persistent inflationary pressures through ongoing monetary policy tightening. The S&P 500 Index closed down by 2.50%, turning lower from resistance at the declining 100-day moving average and slicing back below its 50-day that attempted to hold support coming into this week. The benchmark is now reaching back towards short-term support at its 20-day moving average at 3730. Momentum indicators are showing signs of rolling over following the recent rebound from the mid-October low, threatening a sell signal in the days ahead.

Today, in our Market Outlook to subscribers, we discuss the following:

- The violation of the rising short-term trend on the S&P 500 Index

- Subdued reaction in the bond market following the Fed event

- Weekly petroleum status, the price of oil, and how to play the energy sector from a seasonal perspective

- US Vehicle Sales and the seasonal trade in the stocks of the Auto Makers

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 3

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended overly bearish at 1.21.

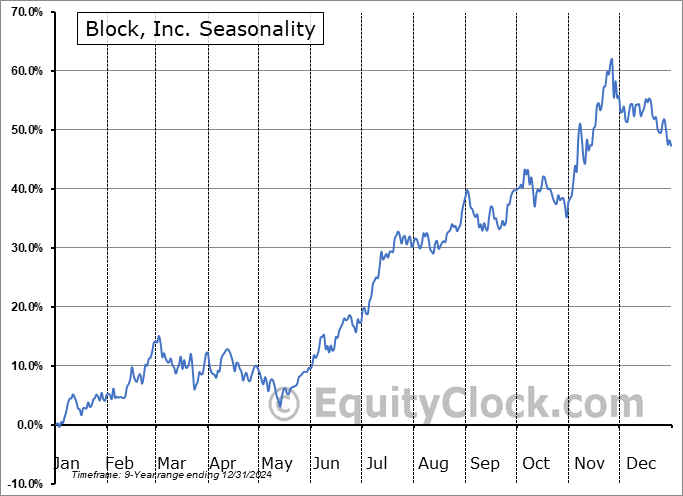

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|