Stock Market Outlook for November 18, 2022

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Vanguard Large-Cap ETF (NYSE:VV) Seasonal Chart

Clough Global Dividend and Income Fund (AMEX:GLV) Seasonal Chart

iShares Russell Mid-Cap Value ETF (NYSE:IWS) Seasonal Chart

CGI Inc. (NYSE:GIB) Seasonal Chart

Exco Technologies Ltd. (TSE:XTC.TO) Seasonal Chart

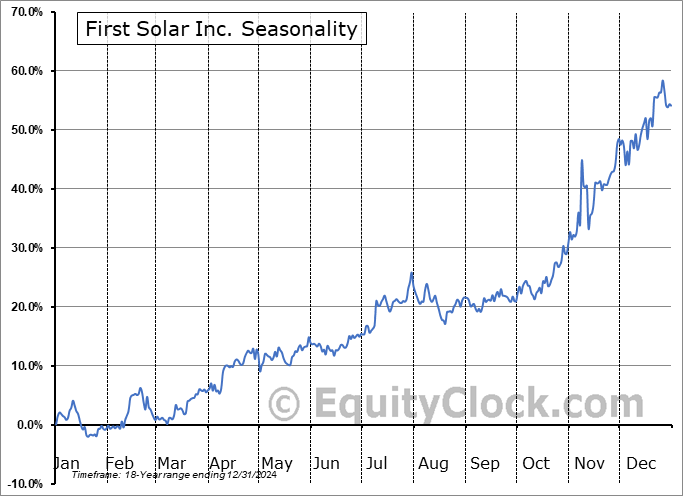

First Solar Inc. (NASD:FSLR) Seasonal Chart

Omega Healthcare Invs, Inc. (NYSE:OHI) Seasonal Chart

Superior Plus Corp. (TSE:SPB.TO) Seasonal Chart

The Markets

Stocks closed slightly lower on Thursday as investors reacted to some hawkish Fed speak that sent treasury yields higher. The S&P 500 Index ended down by just less than three-tenths of one percent, continuing to digest the gains from the past week. Horizontal support at 3900 was tested at the lows of the session and buyers stepped in to defend the level as we head into a seasonally positive time of the year with the US Thanksgiving holiday next week. The short-term trend of the market remains positive, supported by its rising 20-day moving average. Momentum indicators are showing the same, rising back above their middle lines in the past week and attempting to relinquish the bearish characteristics that have plagued the the benchmark all year. The span between 3850 and 3900 remains an important zone of support.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Thanksgiving Week tendencies for stocks and how we are positioning for the positive timeframe ahead

- US Housing Starts and the seasonal trade in the home builders

- Philadelphia Fed Manufacturing Index

- Weekly Jobless Claims

- Canada CPI and using the market performance of 1981/82 as a blueprint of what to expect moving forward

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 18

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended neutral at 0.97

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|