Stock Market Outlook for March 28, 2023

Market is in risk-off mode.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Magna International Inc. (NYSE:MGA) Seasonal Chart

Cenovus Energy Inc. (NYSE:CVE) Seasonal Chart

Laredo Petroleum Holdings, Inc. (NYSE:LPI) Seasonal Chart

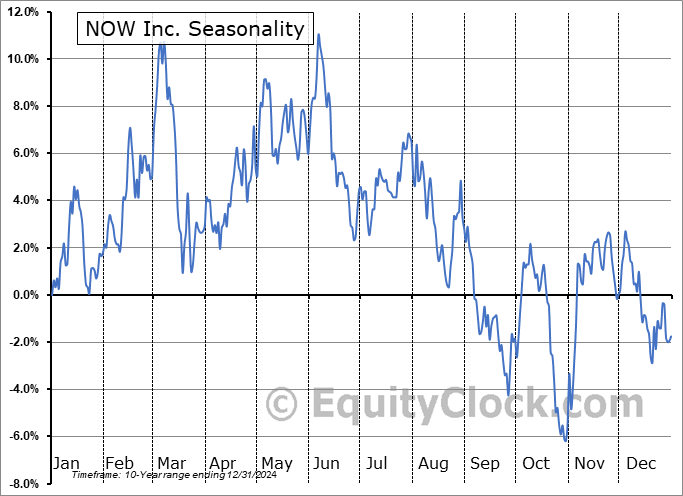

NOW Inc. (NYSE:DNOW) Seasonal Chart

The Markets

Stocks gained in the first session of the last week of the quarter as portfolio managers started the portfolio rebalance process by rotating away from some of their winners (eg. technology, treasury bonds) and correcting diminished allocations in the beaten down energy and financial sectors. The S&P 500 Index closed with a gain of less than two-tenths of one percent, once again taking a swing at resistance of the 50-day moving average at 4014. The confluence of major moving averages in the range between 3900 and 4000 remains a threat to cap the broad market benchmark at this time that traditionally sees the benefit from quarter-end rebalancing and start of the month/quarter inflows in April. A rejection from this zone would inevitably lead to a test and eventual break of the December low at 4764, a violation that would have negative implications for the intermediate trend spanning the next few months. There are still sectors in this market that are showing intermediate paths that are worthy to Accumulate, while a growing majority are either subject to Avoiding or simply holding a Neutral bias. You can find the complete breakdown of what we see of each segment of the market in our weekly chart books.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books update: Find out which sector ETF joins our list of market segments to Accumulate

- Gold or Gold Miners: We weigh in with our bias and how to play precious metal exposure going forward

- The shift towards risk aversion

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for March 28

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.93.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|