Stock Market Outlook for May 3, 2023

The largest decline on record for retail job openings during the first quarter is not exactly an indication of a thriving consumer economy.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Nu Skin Enterprises, Inc. (NYSE:NUS) Seasonal Chart

Fresh Del Monte Produce (NYSE:FDP) Seasonal Chart

Seagen (NASD:SGEN) Seasonal Chart

Gabelli Utility Trust (NYSE:GUT) Seasonal Chart

Invesco DWA Momentum ETF (NASD:PDP) Seasonal Chart

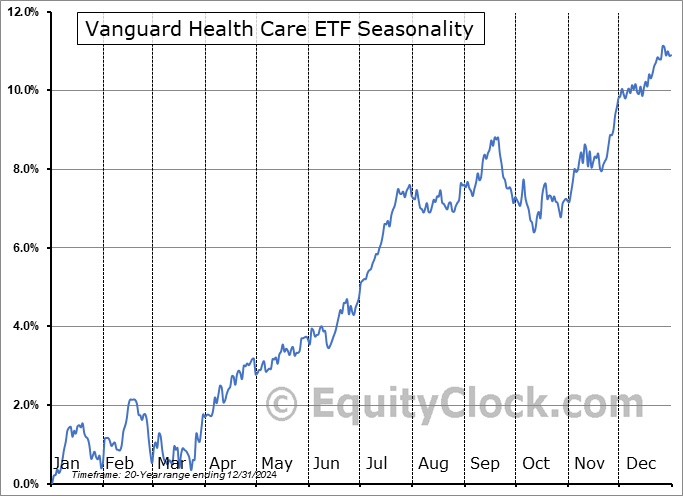

Vanguard Health Care ETF (NYSE:VHT) Seasonal Chart

Medpace Holdings, Inc. (NASD:MEDP) Seasonal Chart

The Markets

The market is certainly providing indication that we shouldn’t overstay our welcome in risk assets (stocks) as the best six month trend for equities nears its average peak. The S&P 500 Index closed lower by 1.16%, pulling back to the lower bound of the range of resistance between 4100 and 4200 that it has been struggling with for the better part of a year. MACD remains on a sell signal that was triggered last week and the momentum indicator is showing signs of pushing lower again as it rolls over below previous trendline support that kept momentum on a positive tilt since the October low. The congestion of major moving averages between 3950 and 4050 remain in positions of support. Overall, while the lack of upside momentum in the market remains obvious, something that threatens a reset/pullback of equity prices moving forward, Tuesday’s shakeout was far from the death-blow to signal, definitively, that a peak to the best six month of the year trend is in. We remain cognizant of the degradation of core-cyclical sectors and various segments that we have no desire to participate in anyways, according to our chart books, as we transition into the risk-off time of the year for stocks starting in May.

Today, in our Market Outlook to subscribers, we discuss the following:

- The downfall of stocks in the banking industry

- Oil back below support

- Job Openings and Labor Turnover Survey (JOLTs)

- US Factory Orders

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 3

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bearish at 1.02.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|