Stock Market Outlook for May 30, 2023

Despite the S&P 500 Index closing higher, last week was generally a losing week for stocks as everything outside of growth/technology sold-off.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Amgen, Inc. (NASD:AMGN) Seasonal Chart

Lipocine Inc. (NASD:LPCN) Seasonal Chart

iShares International Treasury Bond ETF (NASD:IGOV) Seasonal Chart

Edison Intl, Inc. (NYSE:EIX) Seasonal Chart

Synopsys, Inc. (NASD:SNPS) Seasonal Chart

ATRION Corp. (NASD:ATRI) Seasonal Chart

National Retail Properties Inc. (NYSE:NNN) Seasonal Chart

Note: As a result of the Memorial Day closure of US markets on Monday, our next report will be released on Tuesday. Have a great weekend!

The Markets

Stocks closed generally higher ahead of the Memorial Day long weekend in the US as investors anticipated a debt ceiling deal in time to avoid default around the start of June. The S&P 500 Index jumped by 1.30%, led, primarily, by ongoing strength in growth sectors of the market as investors flood back into last year’s laggard. The gain on the day pushes the large-cap benchmark marginally above the band of resistance that had been persistent for months between 4100 and 4200. Support remains solid around the congestion of rising major moving averages between 3980 and 4080. Despite another MACD crossover, this time to the upside, the recent slope of both MACD and RSI continue to lean negative, diverging from price. The days surrounding the Memorial Day holiday tend to be positive, averaging a short-term upswing into the start of June, after which mean reversion and general portfolio re-allocations ahead of the end of the second quarter are the norm, a gyration that will put the recent strength in the technology sector to the test.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- Capitalization weighted benchmark up for the week, but stocks were generally down

- The lack of enthusiasm that the market is expressing towards pure-defensive sectors amidst this growth binge

- US Durable Goods Orders and the opportunities for seasonal portfolios

- US International Trade

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 30

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.88.

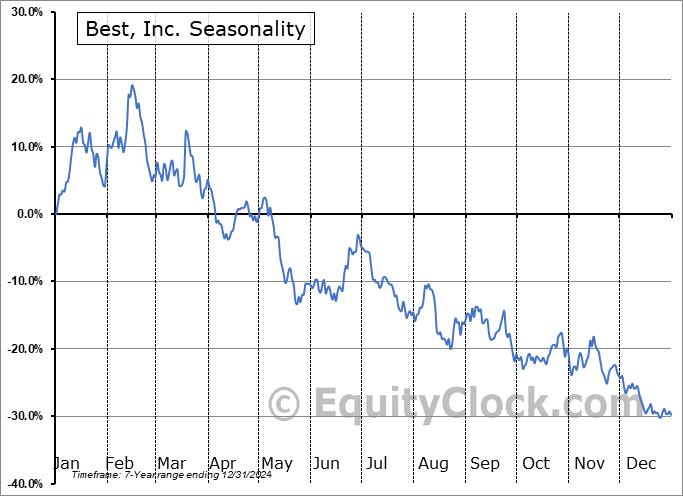

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|