Stock Market Outlook for July 26, 2021

Demand to transport goods remains strong, supportive of this upcoming seasonal trade.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

WW Grainger, Inc. (NYSE:GWW) Seasonal Chart

CenterPoint Energy, Inc. (NYSE:CNP) Seasonal Chart

SPDR Global Dow ETF (NYSE:DGT) Seasonal Chart

Financial Institutions, Inc. (NASD:FISI) Seasonal Chart

South State Corp. (NASD:SSB) Seasonal Chart

BMO S&P/TSX Equal Weight Industrials Index ETF (TSE:ZIN.TO) Seasonal Chart

CDW Corp. (NASD:CDW) Seasonal Chart

WisdomTree High Dividend Fund (NYSE:DHS) Seasonal Chart

CommVault Systems Inc. (NASD:CVLT) Seasonal Chart

Willdan Group Inc. (NASD:WLDN) Seasonal Chart

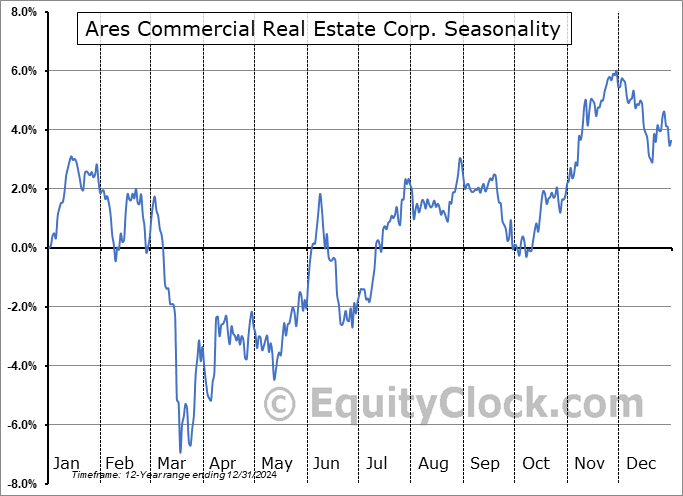

Ares Commercial Real Estate Corp. (NYSE:ACRE) Seasonal Chart

iShares U.S. High Yield Fixed Income Index ETF (CAD-Hedged) (TSE:CHB.TO) Seasonal Chart

Apple, Inc. (NASD:AAPL) Seasonal Chart

Tetra Tech Inc. (NASD:TTEK) Seasonal Chart

FutureFuel Corp. (NYSE:FF) Seasonal Chart

Hillenbrand Inc. (NYSE:HI) Seasonal Chart

iShares Global Monthly Dividend Index ETF (CAD-Hedged) (TSE:CYH.TO) Seasonal Chart

iShares Canadian Financial Monthly Income ETF (TSE:FIE.TO) Seasonal Chart

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) Seasonal Chart

Â

Â

The Markets

Stocks continued to claw their way out of the hole that was dug to start the week, posting another session of solid gains. The S&P 500 Index closed higher by around one percent, supported by communications services, which got a lift from strong earnings from Snap. The benchmark broke above the previous peak charted in the middle of July around 4393 to set a new record intraday and closing high. Support remains intact at the rising 50-day moving average, keeping the intermediate path of higher-highs and higher-lows alive. The limits of the rising trend channel continue to be seen around 4275 and 4475.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the S&P 500 Index

- Reconciling the strength in stocks with the struggling technical backdrop beneath the surface

- Shipping activity and the seasonal trade in the transportation sector

- Canada Retail Sales and what is driving the action

Subscribe now and we’ll send this outlook to you.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.88.

Â

Â

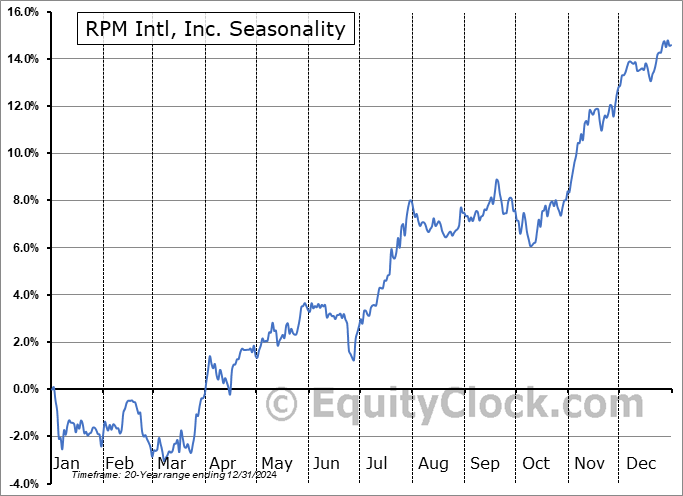

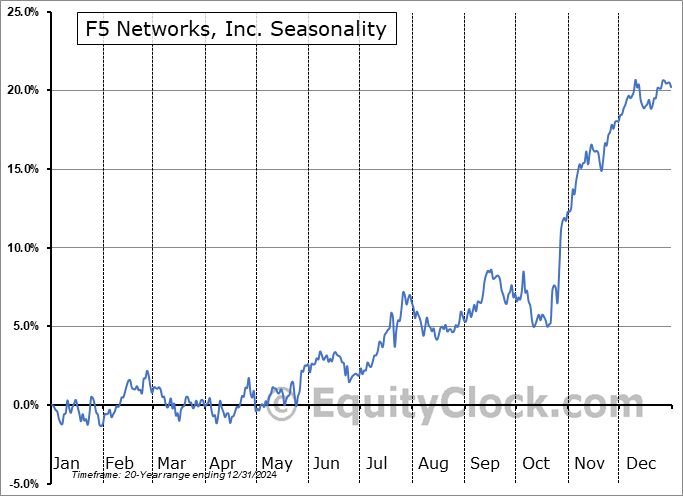

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|