Stock Market Outlook for September 3, 2021

After months of consolidation, stocks in this part of the world are breaking out. Find out how to play it in today’s report.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Oracle Corp. (NYSE:ORCL) Seasonal Chart

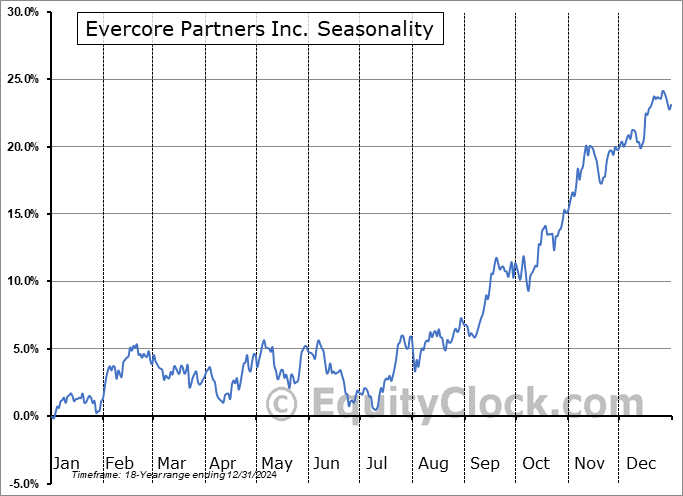

Evercore Partners Inc. (NYSE:EVR) Seasonal Chart

Pampa Energia SA (NYSE:PAM) Seasonal Chart

Chemung Financial Corp. (NASD:CHMG) Seasonal Chart

FlexShares Quality Dividend Dynamic Index Fund (AMEX:QDYN) Seasonal Chart

Â

Â

The Markets

Stocks drifted higher ahead of the release of payroll data on Friday. The S&P 500 Index edged higher by the closing bell to return almost three-tenths of one percent, still pressuring the mid-point to its approximately 200-point trading range, now between 4425 and 4625. Support remains firm at the rising 50-day moving average and it continues to be the hurdle that investors look to in order to ratchet up exposure to the ongoing rise in stocks. However, the hesitation of investors to pick up stocks at these heights continues to be seen, as emphasized by the waning upside momentum. Reaction to the monthly payroll report in the US will be closely monitored to determine if the sluggish trading in the lower half of the rising 200-point range will continue into the end of the quarter or whether a reinvigoration of upside momentum in the upper half of the rising range can be achieved.

Today, in our Market Outlook to subscribers, we discuss the following:

- The importance of the direction of the US Dollar following August’s payroll result

- The breakout on the EAFE Index ETF and which countries in the region you should target

- Weekly jobless claims and a preview of the monthly Non-Farm Payroll report for August

- Natural gas inventories and how the commodity ranks according to the three prongs to our approach

- US Factory Orders and what is driving activity

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.68.

Â

Â

Seasonal charts of companies reporting earnings today:

- No significant reports scheduled

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|