Stock Market Outlook for September 27, 2021

However you slice it, the average start to the period of seasonal strength for the equity market is near.

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Danaher Corp. (NYSE:DHR) Seasonal Chart

Fulton Financial Corp. (NASD:FULT) Seasonal Chart

Lear Corp. (NYSE:LEA) Seasonal Chart

XPO Logistics, Inc. (NYSE:XPO) Seasonal Chart

iShares S&P/TSX Capped Information Technology Index ETF (TSE:XIT.TO) Seasonal Chart

John Hancock Bank and Thrift Opportunity Fund (NYSE:BTO) Seasonal Chart

Global X China Financials ETF (NYSE:CHIX) Seasonal Chart

AAR Corp. (NYSE:AIR) Seasonal Chart

Generac Holdings Inc. (NYSE:GNRC) Seasonal Chart

Schnitzer Steel Industries, Inc. (NASD:SCHN) Seasonal Chart

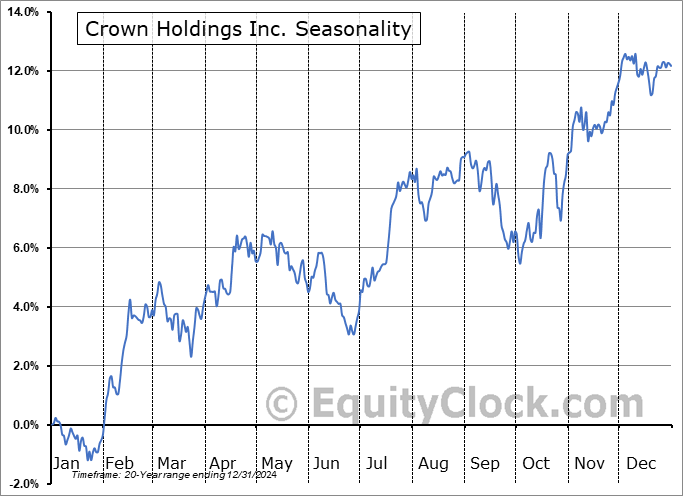

Crown Holdings Inc. (NYSE:CCK) Seasonal Chart

Materials Select Sector SPDR Fund (NYSE:XLB) Seasonal Chart

Â

Â

The Markets

Stocks drifted higher on Friday as the bulls managed to sustain the gains accumulated in the prior two sessions. The S&P 500 Index added just over a tenth of one percent, holding on to levels above the 50-day moving average. Support has been pegged at the rising 100-day moving average, while the lower limit of the previous rising trend channel remains in a position of resistance around 4475. Mean reversion into the end of the quarter remains a dominant theme with energy and financial stocks topping the leaderboard at the expense of health care and technology, two of this quarters winners. Just a few more sessions remain in this period of peak volatility for stocks that coincides with end of quarter rebalancing.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The lack of risk aversion amidst the market volatility

- The US Dollar Index

- The average start to the period of seasonal strength for stocks

- The Semiconductor Industry

- US New Home Sales and the homebuilding industry

Subscribe now and we’ll send this outlook to you.

Sentiment on Friday, as gauged by the put-call ratio, ended neutral at 1.00.Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

TSE Composite

| Sponsored By... |

|