Stock Market Outlook for October 15, 2021

Oil inventories are on the rise for the first time since February, but with upbeat demand and the return to pre-hurricane levels of production of Oil, we see no reason for concern.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Mattel, Inc. (NASD:MAT) Seasonal Chart

Pinnacle West Cap Corp. (NYSE:PNW) Seasonal Chart

Waters Corp. (NYSE:WAT) Seasonal Chart

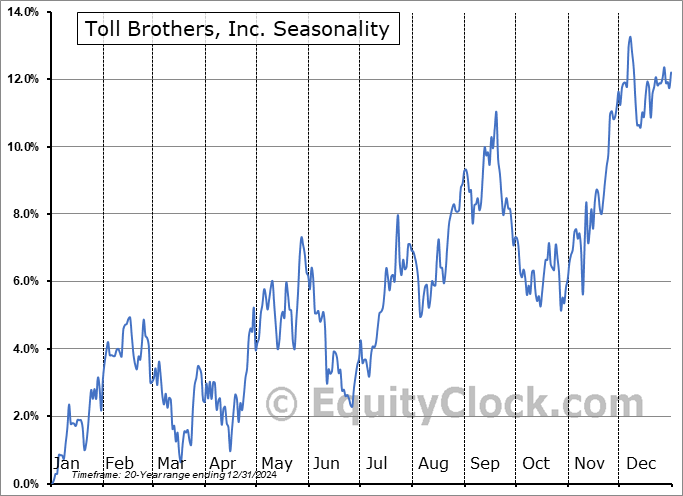

Toll Brothers, Inc. (NYSE:TOL) Seasonal Chart

Commerce Bancshares, Inc. (NASD:CBSH) Seasonal Chart

Acuity Brands, Inc. (NYSE:AYI) Seasonal Chart

Metlife, Inc. (NYSE:MET) Seasonal Chart

AdvisorShares DoubleLine Value Equity ETF (AMEX:DBLV) Seasonal Chart

Carnival Corp. (NYSE:CCL) Seasonal Chart

National Bank of Canada (TSE:NA.TO) Seasonal Chart

Stantec, Inc. (TSE:STN.TO) Seasonal Chart

Toromont Industries Ltd. (TSE:TIH.TO) Seasonal Chart

Cathedral Energy Services Ltd. (TSE:CET.TO) Seasonal Chart

Rollins, Inc. (NYSE:ROL) Seasonal Chart

Sun Life Financial Services of Canada, Inc. (TSE:SLF.TO) Seasonal Chart

Vanguard S&P 500 Index ETF (TSE:VFV.TO) Seasonal Chart

iShares U.S. Financial Services ETF (NYSE:IYG) Seasonal Chart

Invesco KBW Bank ETF (NASD:KBWB) Seasonal Chart

Â

Â

The Markets

Stocks jumped on Thursday as investors digested stronger than expected earnings reports and received better than expected data on the economy. The S&P 500 Index closed with a gain of 1.71%, gapping above its 20-day moving average in the process. A short-term head-and-shoulders bottoming pattern can be observed on the chart as the short-term path of lower-highs and lower-lows from the past month and a half is definitively broken. Subscribers following our model portfolio are benefitting handsomely following allocations enacted around the end of September.

Today, in our Market Outlook to subscribers, we discuss the following:

- Hourly look at the large-cap benchmark and the theoretical target of the short-term bottoming pattern

- Weekly jobless claims and the health of the labor market

- Natural gas inventories and our view of how you should be exposed to the commodity

- Petroleum inventories: How we are benefiting from the strength in the energy sector and the target for the price of Oil

- Canada Manufacturing Sales and the ETFs that are poised to benefit

- Institutional sentiment

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.83.

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|