Stock Market Outlook for October 19, 2021

This week’s list of areas of the market to Accumulate has a cyclical bent following last week’s breakout in the price of Copper.

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Callaway Golf Co. (NYSE:ELY) Seasonal Chart

Marriott Intl Inc New (NASD:MAR) Seasonal Chart

WestRock Co. (NYSE:WRK) Seasonal Chart

Northern Dynasty Minerals Ltd. (TSE:NDM.TO) Seasonal Chart

Janus Henderson Group plc (NYSE:JHG) Seasonal Chart

InterContinental Hotels Group PLC (NYSE:IHG) Seasonal Chart

RBC Quant U.S. Dividend Leaders ETF (TSE:RUD.TO) Seasonal Chart

Coty Inc. (NYSE:COTY) Seasonal Chart

L3Harris Technologies Inc. (NYSE:LHX) Seasonal Chart

Vanguard U.S. Dividend Appreciation Index ETF (TSE:VGG.TO) Seasonal Chart

BMO MSCI USA High Quality Index ETF (TSE:ZUQ.TO) Seasonal Chart

Invesco S&P 500 High Beta ETF (NYSE:SPHB) Seasonal Chart

ProShares UltraShort Yen (NYSE:YCS) Seasonal Chart

Â

Â

The Markets

Stocks clawed their way higher on Monday as investors expect the continuation of strong earnings reports in the days ahead. The S&P 500 Index ended higher by just over a third of one percent, making progress above its 50-day moving average that was broken on Friday. Momentum indicators continue to relinquish characteristics of a bearish trend that had been derived from the breakdown of the equity benchmark in September. MACD has pushed above its middle line, joining the Relative Strength Index (RSI) that had pushed above its middle line in the back half of last week. What was previous resistance at the 50-day moving average (~4438) is now in a position of support. The theoretical upside target of a short-term head-and-shoulders pattern projects upside to 4575, which would be a new all-time high, if achieved.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Notable upgrades and downgrades in this week’s chart books: Find out what has been upgraded to Accumulate this week.

- US Industrial Production and the burdens on activity related to the shortage of semiconductors

- Manufacturer sentiment

Subscribe now and we’ll send this outlook to you.

Investor sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.81.

Â

Â

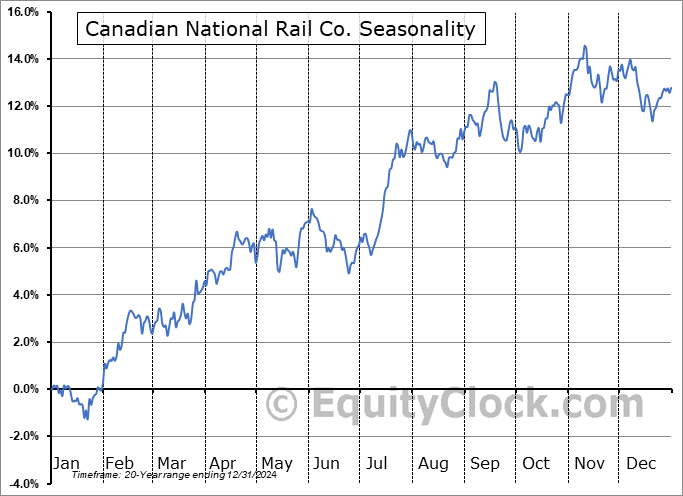

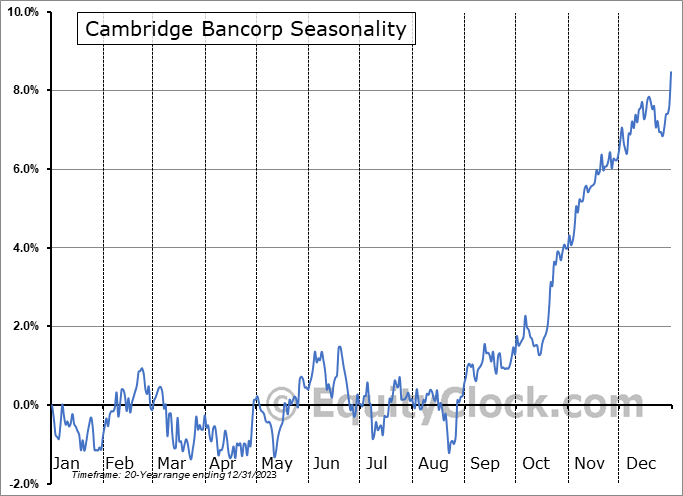

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

TSE Composite

| Sponsored By... |

|