Stock Market Outlook for November 4, 2021

Don’t be fooled by the pullback in the price of oil as the demand fundamentals remain supportive of price.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Lockheed Martin Corp. (NYSE:LMT) Seasonal Chart

Plaza Retail REIT (TSE:PLZ/UN.TO) Seasonal Chart

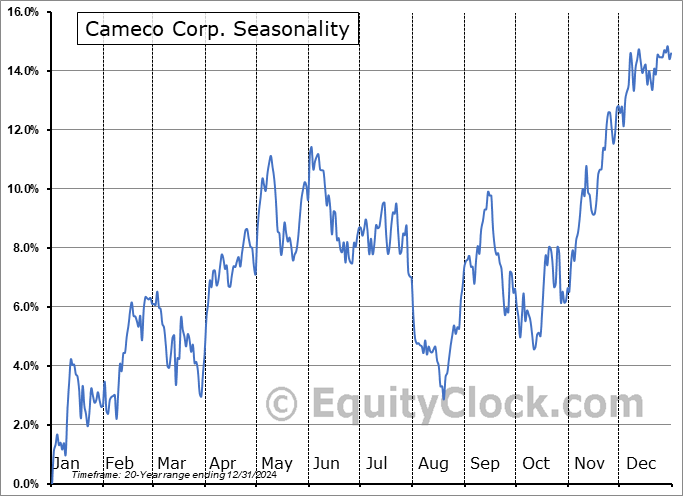

Cameco Corp. (TSE:CCO.TO) Seasonal Chart

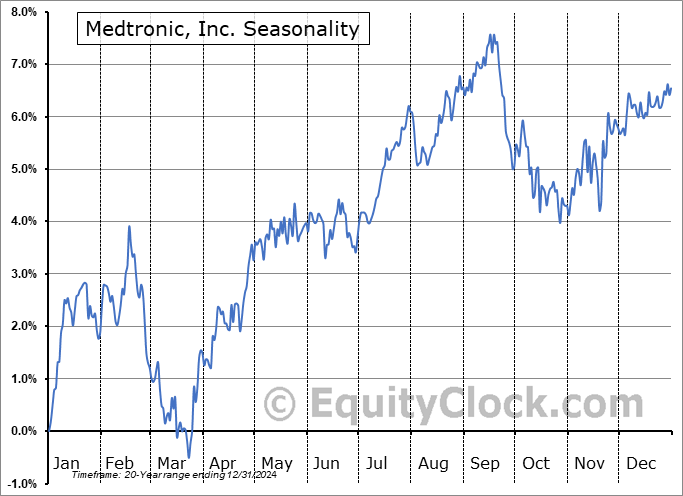

Medtronic, Inc. (NYSE:MDT) Seasonal Chart

Chicos FAS, Inc. (NYSE:CHS) Seasonal Chart

Computer Programs and Systems Inc. (NASD:CPSI) Seasonal Chart

Denny’s Corp. (NASD:DENN) Seasonal Chart

Dynex Capital, Inc. (NYSE:DX) Seasonal Chart

Evergy, Inc. (NYSE:EVRG) Seasonal Chart

Â

Â

The Markets

Stocks continued to surge higher on Wednesday as investors breathed a sigh of relief that that Fed has no plans to become aggressive in its monetary policy until certain conditions are met. The S&P 500 Index gained nearly seven-tenths of one percent, pushing the benchmark further into overbought territory. The Relative Strength Index (RSI) advanced above the threshold that would classify it as being overbought during Tuesday’s session, but, obviously, from Wednesday’s gain, there are no indications that momentum indicators are set to imminently peak. Support at 20 and 50-day moving averages can now be seen at 4510 and 4469, respectively, along with horizontal support at the previous 52-week high of 4545.

Today, in our Market Outlook to subscribers, we discuss the following:

- The breakout of the Russell 2000 and Retail ETFs from significant trading ranges

- US petroleum inventories and the state of demand for energy commodities

- The price of oil and downside risks on this pullback

- Oil refiners

- US Vehicle sales and stocks in the auto industry

- US Factory Orders

- The return of institutional participation in the market

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.70.

Â

Â

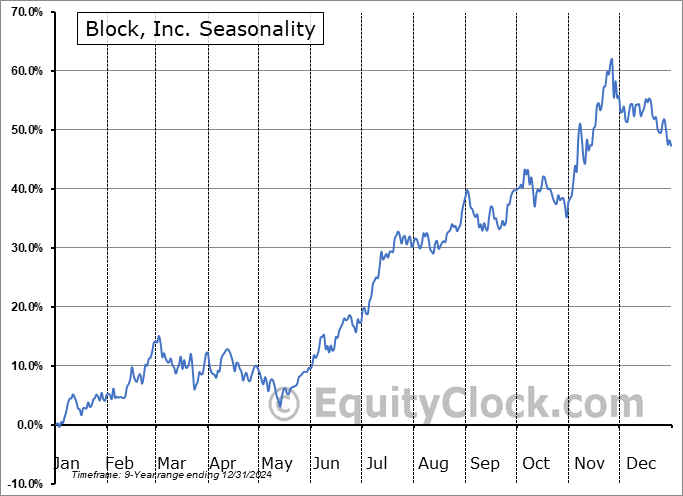

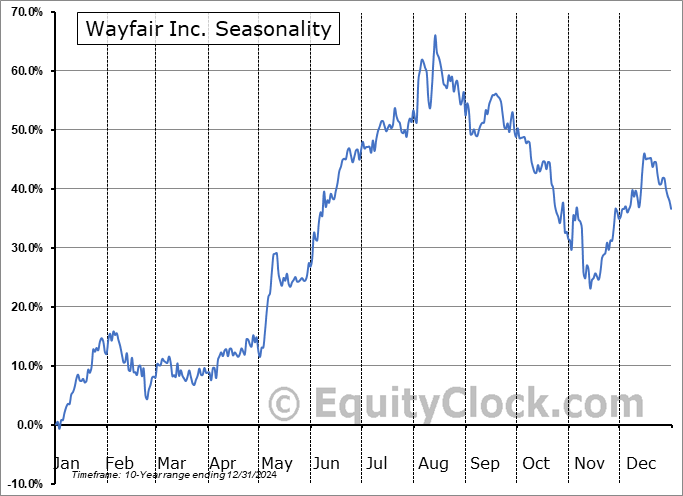

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|