Stock Market Outlook November 11, 2021

Inflationary pressures are starting to become out of control as consumers are being forced to pay more for a wide range of goods.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Riocan Real Estate Investment Trust (TSE:REI/UN.TO) Seasonal Chart

Church & Dwight Co, Inc. (NYSE:CHD) Seasonal Chart

AngioDynamics Inc. (NASD:ANGO) Seasonal Chart

American Vanguard Corp. (NYSE:AVD) Seasonal Chart

National Beverage Corp. (NASD:FIZZ) Seasonal Chart

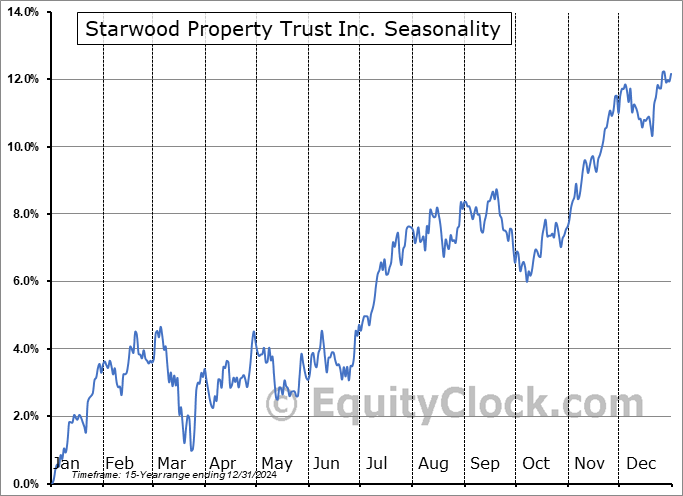

Starwood Property Trust Inc. (NYSE:STWD) Seasonal Chart

Photronics, Inc. (NASD:PLAB) Seasonal Chart

Taiwan Semiconductor Mfg (NYSE:TSM) Seasonal Chart

Osisko Mining Inc. (TSE:OSK.TO) Seasonal Chart

Â

Â

The Markets

Stocks fell on Wednesday following a sharper than expected read of inflation for the month of October. The S&P 500 Index slipped by just over eight-tenths of one percent, continuing to consolidate the gains that have been realized over the past five weeks. The benchmark can still fall by another 50 to 150 points just to get back to levels of short and intermediate support around 20 and 50-day moving averages, now sitting at 4587 and 4487, respectively. The digestion remains a healthy pause in the trajectory of higher-highs and higher-lows, allowing for the next positive setup around the end of the month, coinciding with the US Thanksgiving holiday, a good chance of playing out. So far, the gyrations in the market are playing out according to expectations and we see no reason to deviate from the seasonal playbook through the end of the year, although we do have to acknowledge the risk that the rise in the US Dollar imposes on some of our bets that we are targeting for this last quarter of the year. More on that in our market outlook to subscribers.

Today, in our Market Outlook to subscribers, we discuss the following:

- Inflationary pressures becoming out of control: What is driving the price gains and what the fundamental backdrop suggests to invest in

- Rejection of the long-term bond ETF from horizontal resistance and how we should position through the year ahead amidst the prospect of higher yields

- The jump in the US Dollar Index above short-term resistance and the risk that the rise in the currency imposes on our positioning through the end of the year

- The rise of Gold and Gold Miners and when our opportunity is to become exposed from a seasonal perspective

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.79.

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|