Stock Market Outlook for February 2, 2022

The equity market is showing characteristics of a bearish trend.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Baytex Energy Corp. (TSE:BTE.TO) Seasonal Chart

Best Buy Co, Inc. (NYSE:BBY) Seasonal Chart

Sanderson Farms, Inc. (NASD:SAFM) Seasonal Chart

Tronox Holdings plc (NYSE:TROX) Seasonal Chart

American Realty Investors Inc. (NYSE:ARL) Seasonal Chart

Genesis Land Development Corp. (TSE:GDC.TO) Seasonal Chart

The Markets

Stocks closed higher for a third straight session as the market continues to rebound from the excessive negativity that was recorded through the middle of January. The S&P 500 Index added seven-tenths of one percent, reaching back to levels around the 100-day moving average. Horizontal resistance at 4530 has been broken, clearing a path for the benchmark to make an attempt at the declining 50-day moving average. Momentum indicators, while rebounding from oversold territory, continue show a series of lower-highs and lower-lows and characteristics of a bearish trend are evolving. We have benefitted nicely from this snap-back rally with timely additions to our equity exposure on Monday and Tuesday of last week, but, at the present time, this appears to be nothing more than a short-term snap-back that may require us to book our profits and retrench until the technicals show something more conducive to be constructive longer-term.

Today, in our Market Outlook to subscribers, we discuss the following:

- One of the technical indicators that is showing characteristics of a bearish trend

- Credit spreads

- Job Openings and Labor Turnover Survey (JOLTS)

- Canada GDP

Subscribe now and we’ll send this report to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.95.

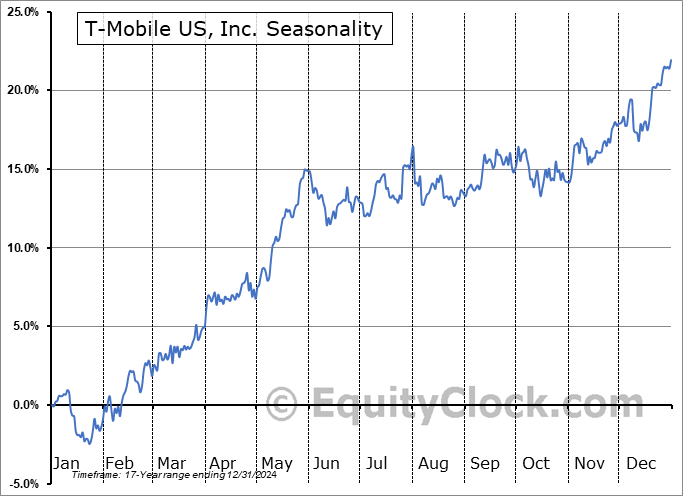

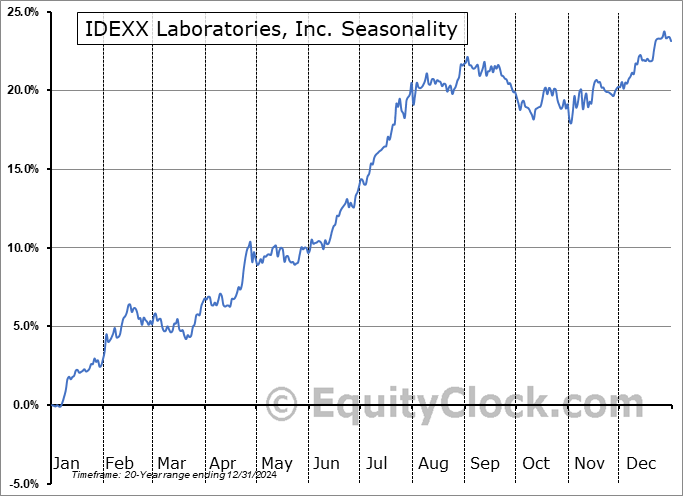

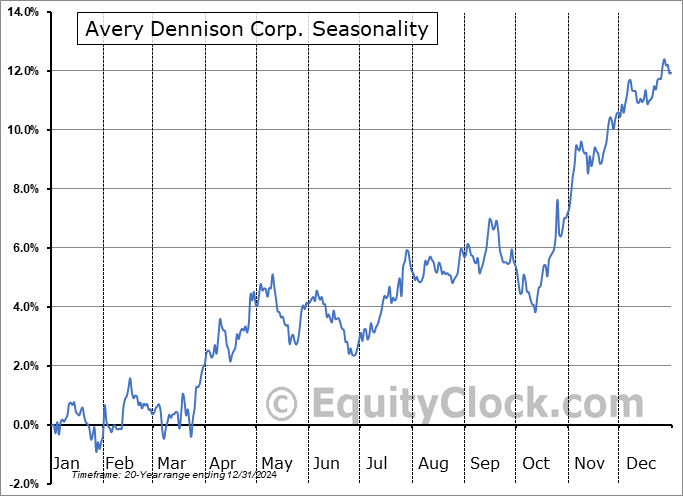

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|