Stock Market Outlook for March 14, 2022

The trends in Canadian employment data continue to suggest a fundamental tailwind for resource stocks.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares MSCI International Developed Quality Factor ETF (AMEX:IQLT) Seasonal Chart

iShares MSCI Kokusai ETF (NYSE:TOK) Seasonal Chart

iShares International Developed Real Estate ETF (NASD:IFGL) Seasonal Chart

PPL Corp. (NYSE:PPL) Seasonal Chart

Empire Co. Ltd. (TSE:EMP/A.TO) Seasonal Chart

Ship Finance Intl Ltd. (NYSE:SFL) Seasonal Chart

SAP SE (NYSE:SAP) Seasonal Chart

SPDR S&P International Dividend ETF (NYSE:DWX) Seasonal Chart

iShares MSCI EAFE Growth ETF (NYSE:EFG) Seasonal Chart

iShares Global Utilities ETF (NYSE:JXI) Seasonal Chart

Kirkland Lake Gold Ltd. (NYSE:KL) Seasonal Chart

iShares MSCI Saudi Arabia Capped ETF (AMEX:KSA) Seasonal Chart

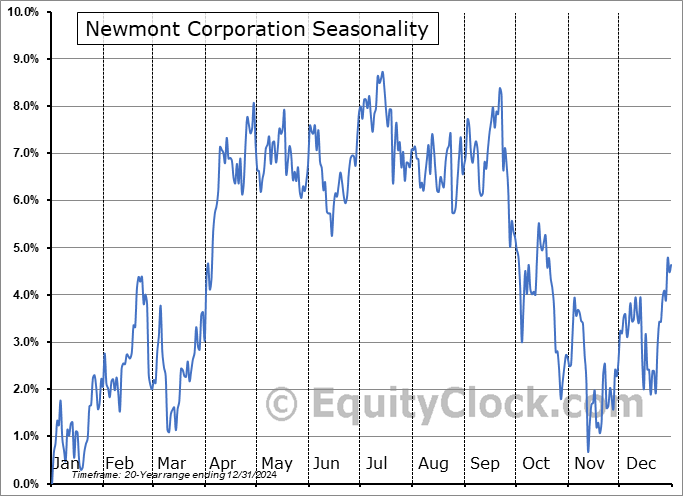

Newmont Corporation (NYSE:NEM) Seasonal Chart

Kansas City Southern Corp. (NYSE:KSU) Seasonal Chart

iShares MSCI ACWI ex US ETF (NASD:ACWX) Seasonal Chart

The Markets

Stocks drifted lower to end the week as investors continue to monitor developments pertaining to the tensions between Russia and Ukraine. The S&P 500 Index closed lower by 1.30%, still remaining pegged below previous horizontal support, now resistance at 4280. The level remains threatening and the longer that it struggles to overcome this barrier overhead, the more likely a downside resolution will be realized. Buyers continue to support the benchmark at 4150 and through the next couple of weeks the benchmark will have difficulty moving definitively below this apparent barrier without some catalyst to justify it. Momentum indicators continue to narrow within a triangle pattern after drifting essentially sideways for the past month and a half. Waning selling pressures are implied, although, admittedly, the market is holding on by a thread.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- Tendency of the market through the back half of March

- Hints of a peak in the VIX

- Canada Labour Force Survey and what is driving activity

- Canadian equities

Subscribe now and we’ll send this outlook to you.

Sentiment on Friday, as gauged by the put-call ratio, ended bearish at 1.07.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|