Stock Market Outlook for October 27, 2022

As the dollar falls, the price of copper has become supported, but unfortunately the longer-term fundamentals of the commodity leave little to be desired.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Vanguard S&P Mid-Cap 400 ETF (NYSE:IVOO) Seasonal Chart

Globus Medical, Inc. (NYSE:GMED) Seasonal Chart

Ocular Therapeutix Inc. (NASD:OCUL) Seasonal Chart

Cornerstone Building Brands, Inc. (NYSE:CNR) Seasonal Chart

Mosaic Co. (NYSE:MOS) Seasonal Chart

Invesco Dynamic Networking ETF (NYSE:PXQ) Seasonal Chart

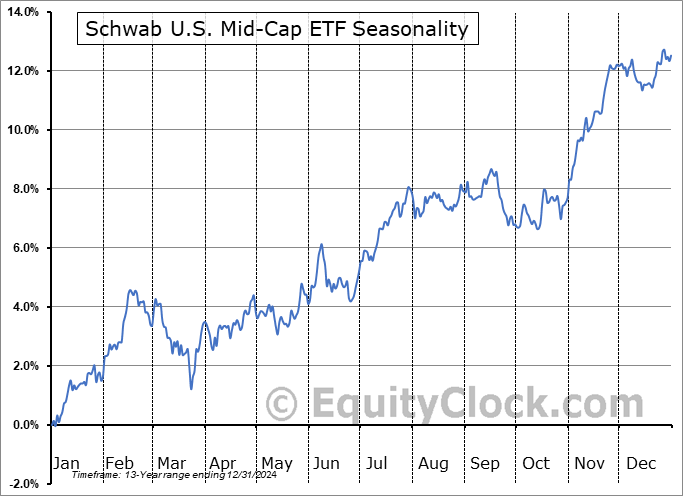

Schwab U.S. Mid-Cap ETF (NYSE:SCHM) Seasonal Chart

DR Horton Inc. (NYSE:DHI) Seasonal Chart

Nucor Corp. (NYSE:NUE) Seasonal Chart

Western Digital Corp. (NASD:WDC) Seasonal Chart

Manulife Financial Corp. (TSE:MFC.TO) Seasonal Chart

The Descartes Systems Group, Inc. (TSE:DSG.TO) Seasonal Chart

Martin Marietta Materials (NYSE:MLM) Seasonal Chart

The Markets

Stocks traded mixed on Wednesday as a poor reaction to earnings from Alphabet (GOOGL) and Microsoft (MSFT) led to a pause in the recent strength in the S&P 500 Index. The large-cap benchmark fell by three-quarters one percent, showing initial negative reaction to declining resistance at the 50-day moving average and horizontal resistance at 3900. Early signs of buying exhaustion have been provided at this intermediate barrier, a level that we have speculated will serve as a hurdle to sell into in order to reduce equity exposure. The lack of definitive reaction to the intermediate resistance makes this call less certain, for now. The ultra-short-term trend of the market still remains that of higher-highs and higher-lows and momentum indicators continue to point higher. Previous short-term resistance at the 20-day moving average is in a position of support around 3700. Despite the negative reaction for this benchmark on the day given its weight in the technology sector, there is not the catalyst, as of yet, to suggest reducing equity exposure again in order to shelter against the more intermediate declining trend in the market that remains intact. While our cash allocation in the Super Simple Seasonal Portfolio is at one of the lowest levels of the year following recently increased risk exposure amidst the bottoming of stocks and bonds, we are willing and able to ramp our cash allocation higher again should conditions warrant. Seasonally, the close of the 27th of October has traditionally been the best time of the year to be a buyer of stocks to take advantage of the best six months of the year for the equity market and we are more inclined to sit with our elevated risk exposure at least until we get through one of the strongest parts of November at the beginning of the month.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Petroleum Status and the rebound in the price of oil above intermediate resistance at its 50-day moving average

- Copper

- US New Home Sales and the seasonal trade in homebuilding stocks

- US International Trade

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended neutral at 0.94.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|