Stock Market Outlook for October 25, 2023

The underperformance of high-beta presents concern pertaining to the risk-on time of year for stocks through the next six months.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Stratus Properties, Inc. (NASD:STRS) Seasonal Chart

Argenx SE (NASD:ARGX) Seasonal Chart

Wolfspeed, Inc. (NYSE:WOLF) Seasonal Chart

Invesco S&P 500 Pure Value ETF (NYSE:RPV) Seasonal Chart

Japan Equity Fund, Inc. (NYSE:JEQ) Seasonal Chart

iShares U.S. Broker-Dealers & Securities Exchanges ETF (NYSE:IAI) Seasonal Chart

Comcast Corp. (NASD:CMCSA) Seasonal Chart

Radware Ltd. (NASD:RDWR) Seasonal Chart

MaxLinear Inc. (NASD:MXL) Seasonal Chart

Hanover Insurance Group, Inc. (NYSE:THG) Seasonal Chart

Kaiser Aluminum Corp. (NASD:KALU) Seasonal Chart

Foot Locker, Inc. (NYSE:FL) Seasonal Chart

Omnicom Group, Inc. (NYSE:OMC) Seasonal Chart

Eli Lilly & Co. (NYSE:LLY) Seasonal Chart

The Markets

Stocks closed higher on Tuesday as investors looked forward to earnings from a number of tech titans through the days ahead. The S&P 500 Index ended higher by just less than three-quarters of one percent, remaining firm above the significant band of horizontal support between 4100 and 4200. Momentum indicators are attempting to make the turn higher again following the benchmark’s mid-October rejection from resistance at the 50-day moving average. So far, the index has acted with near precision toward levels of technical significance and the bias through the month ahead is for a rebound from the aforementioned band of support coinciding with the start of the best six month of the year timeframe that starts in the next few days.

Today, in our Market Outlook to subscribers, we discuss the following:

- A buy signal for stocks according to our simplistic strategy using the VIX

- The ongoing underperformance of high-beta

- Uranium

- Shipping volumes and expenditures in the economy

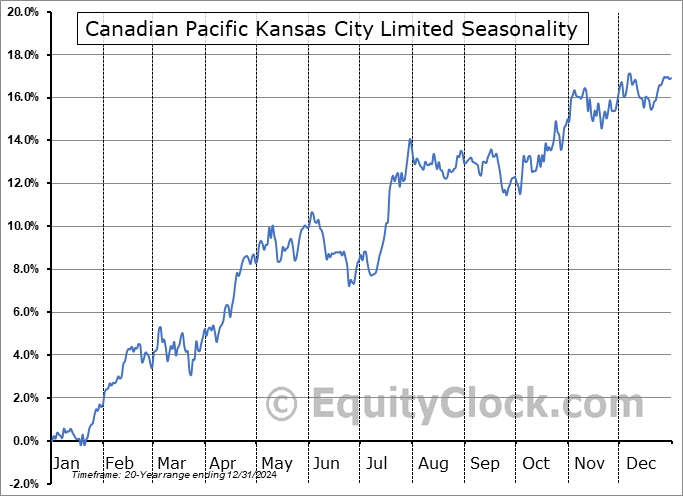

- Transportation industry

- Multi-year low for shipping container prices

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 25

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bullish at 0.93.

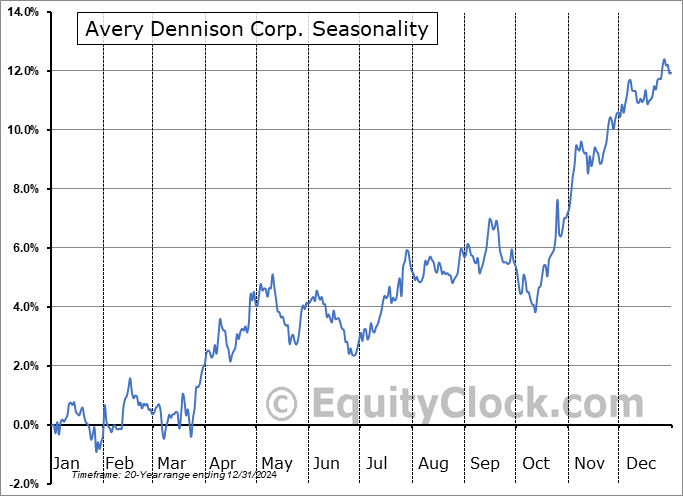

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|