Stock Market Outlook for November 2, 2023

Stocks are unwinding an extreme bearish bias that built up in the market in recent weeks, ahead of the best six months of the year timeframe for the asset class.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Lincoln Educational Services Corp. (NASD:LINC) Seasonal Chart

iShares Global Industrials ETF (NYSE:EXI) Seasonal Chart

Arista Networks, Inc. (NYSE:ANET) Seasonal Chart

Sun Life Financial Services of Canada, Inc. (TSE:SLF.TO) Seasonal Chart

Assertio Holdings (NASD:ASRT) Seasonal Chart

Analog Devices, Inc. (NASD:ADI) Seasonal Chart

Pizza Pizza Royalty Corp. (TSE:PZA.TO) Seasonal Chart

Wipro Ltd. (NYSE:WIT) Seasonal Chart

Uranium Energy Corp. (AMEX:UEC) Seasonal Chart

Mercer Intl, Inc. (NASD:MERC) Seasonal Chart

Fortinet Inc. (NASD:FTNT) Seasonal Chart

The Markets

Stocks rallied on Wednesday as investors reacted favourably to the latest FOMC announcement that highlighted the continuation of a pause in interest rates following over a year of aggressive hikes. The S&P 500 Index gained just over one percent, continuing to cement support at the lower limit of the band of significance between 4100 and 4200. The benchmark is now at a point of possible resistance at the 200-day moving average at 4243, which could easily give investors pause in the near-term. The 20-day moving average, now at 4269, is increasingly encroaching on the long-term average in what could amount to a bearish crossover in the days ahead. Momentum indicators are on the rebound, showing a divergence versus price ahead of the strength in stocks this week, but characteristics of a bearish trend remain with both MACD and RSI holding below their middle lines. The risk-reward still appears favoruable to accumulating risk (stocks) in the 4100 to 4200 zone, but, as has been highlighted in our reporting, the sustainability of the advance from this significant zone of support is questionable. The short-term trend remains negative, defined by lower-highs and lower-lows, and the intermediate path remains around a pivotal point at the aforementioned span.

Today, in our Market Outlook to subscribers, we discuss the following:

- Investment manager positioning/sentiment

- Manage money exposure to S&P 500 Futures has flipped net long

- Short position in treasury bond futures rebounding from record levels

- Intermediate treasury note prices

- Job Openings and Labor Turnover Survey (JOLTS) and the investment themes within

- US Construction Spending and what it has to say about stocks with exposure

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 2

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended neutral at 0.99.

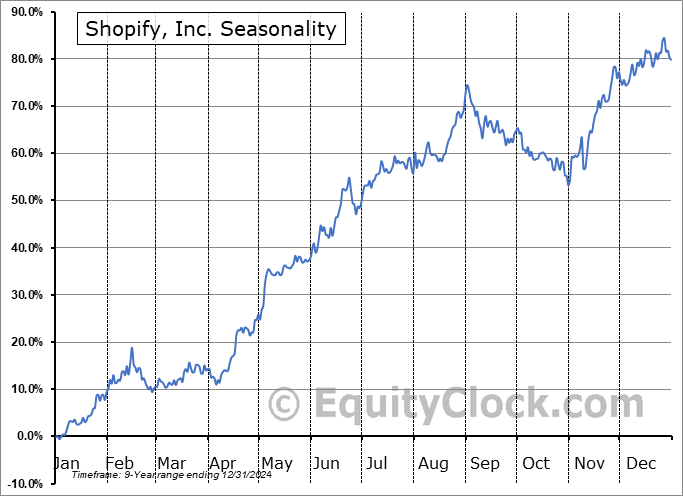

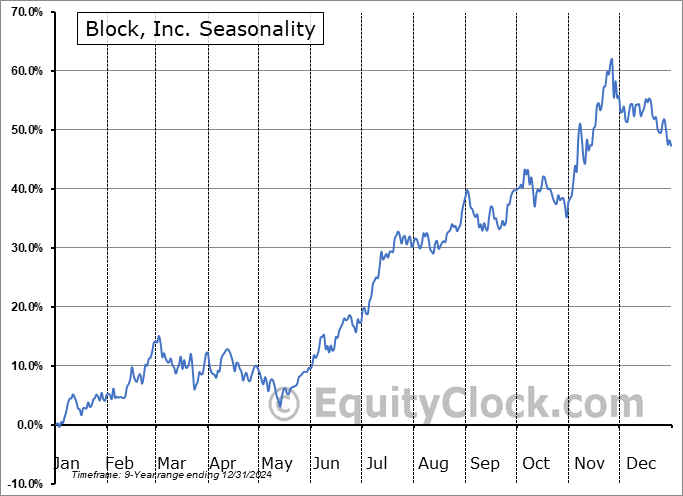

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|