Stock Market Outlook for November 3, 2023

The S&P 500 Index has retraced its recent losses to reach back to the upper limit of its short-term declining trend channel.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Fidelity Quality Factor ETF (AMEX:FQAL) Seasonal Chart

Health Care Select Sector SPDR Fund (NYSE:XLV) Seasonal Chart

Vanguard Large-Cap ETF (NYSE:VV) Seasonal Chart

iShares Core US Value ETF (NASD:IUSV) Seasonal Chart

L3Harris Technologies Inc. (NYSE:LHX) Seasonal Chart

Advanced Emissions Solutions, Inc. (NASD:ADES) Seasonal Chart

BioMarin Pharmaceutical, Inc. (NASD:BMRN) Seasonal Chart

Marinemax, Inc. (NYSE:HZO) Seasonal Chart

Ritchie Bros. Auctioneers Inc. (TSE:RBA.TO) Seasonal Chart

Industrial-Alliance Life Insurance Co. (TSE:IAG.TO) Seasonal Chart

Cargojet Inc. (TSE:CJT.TO) Seasonal Chart

Oshkosh Corp. (NYSE:OSK) Seasonal Chart

Flexsteel Industries, Inc. (NASD:FLXS) Seasonal Chart

Lockheed Martin Corp. (NYSE:LMT) Seasonal Chart

Corby Spirit and Wine Ltd. (TSE:CSW/A.TO) Seasonal Chart

Rogers Sugar Inc. (TSE:RSI.TO) Seasonal Chart

Exchange Income Corp. (TSE:EIF.TO) Seasonal Chart

Centene Corp. (NYSE:CNC) Seasonal Chart

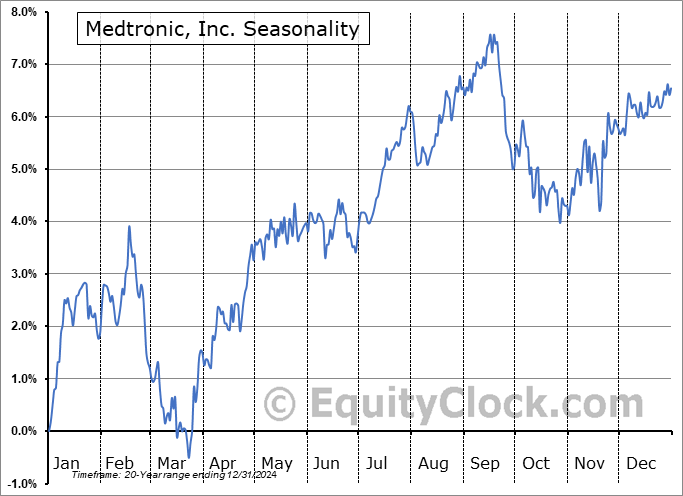

Medtronic, Inc. (NYSE:MDT) Seasonal Chart

The Markets

Stocks rallied for a fourth straight session on Thursday as a plunge in the cost of borrowing had investors taking on risk. The S&P 500 Index added 1.89%, gaping back above its 20 and 200-day moving averages to close back in on recent defined resistance at the 50-day moving average (~4350). The intermediate moving average coincides with the upper limit of the declining trend channel that the benchmark has been in since July, presenting another hurdle where digestion of recent strength may be realized. The benchmark remains resilient above the horizontal band of support between 4100 and 4200, providing the ideal risk-reward to accumulating risk (stocks), so long as price remains above. MACD has charted a new buy signal by crossing above its signal line and the Relative Strength Index (RSI) has inched above its middle line. These momentum indicators had been suggesting waning selling pressures over the past week, lining us up for the rebound of prices that has now been realized.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Vehicle Sales and the stocks of auto makers

- Weekly Jobless Claims and the health of the labor market

- A preview of what to expect for October’s Non-Farm Payroll report

- Weekly Petroleum Status and energy sector stocks

- The seasonal trade in Natural Gas as we reach the time of year when inventory levels peak ahead of the winter

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 3

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended close to Neutral at 0.97.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|