Stock Market Outlook for November 20, 2023

It is no surprise that the rally in stocks has coincided with the largest expansion of net assets on the Fed’s balance sheet since March.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Ladder Capital Corp. (NYSE:LADR) Seasonal Chart

Gabelli Dividend & Income Trust (NYSE:GDV) Seasonal Chart

iShares S&P Small-Cap 600 Value ETF (NYSE:IJS) Seasonal Chart

iShares Micro-Cap ETF (NYSE:IWC) Seasonal Chart

Vanguard Real Estate ETF (NYSE:VNQ) Seasonal Chart

Barclays Plc (NYSE:BCS) Seasonal Chart

Cisco Systems, Inc. (NASD:CSCO) Seasonal Chart

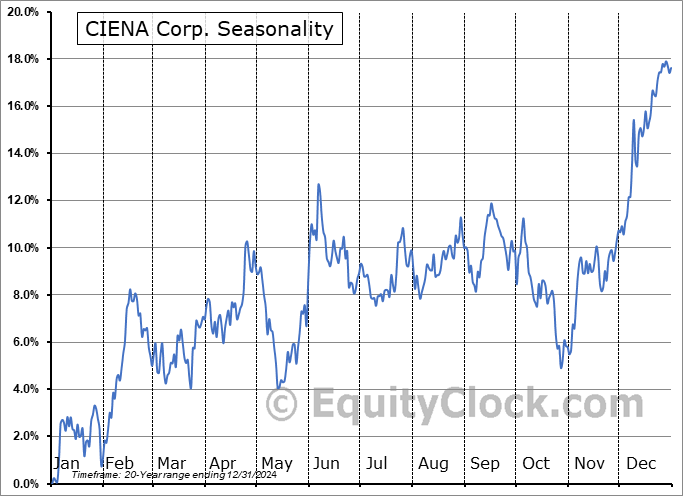

CIENA Corp. (NYSE:CIEN) Seasonal Chart

Parkland Fuel Corp. (TSE:PKI.TO) Seasonal Chart

BorgWarner, Inc. (NYSE:BWA) Seasonal Chart

Mohawk Inds, Inc. (NYSE:MHK) Seasonal Chart

Omega Healthcare Invs, Inc. (NYSE:OHI) Seasonal Chart

Computer Programs and Systems Inc. (NASD:CPSI) Seasonal Chart

Titan Intl, Inc. (NYSE:TWI) Seasonal Chart

Honda Motor Co. Ltd. (NYSE:HMC) Seasonal Chart

Allegheny Technologies (NYSE:ATI) Seasonal Chart

Lazard Ltd (NYSE:LAZ) Seasonal Chart

Builders FirstSource, Inc. (NYSE:BLDR) Seasonal Chart

Energizer Holdings, Inc. (NYSE:ENR) Seasonal Chart

iShares U.S. Home Construction ETF (NYSE:ITB) Seasonal Chart

Invesco Solar ETF (NYSE:TAN) Seasonal Chart

SPDR S&P Metals and Mining ETF (NYSE:XME) Seasonal Chart

Kimco Realty Corp. (NYSE:KIM) Seasonal Chart

Public Storage, Inc. (NYSE:PSA) Seasonal Chart

Wheaton Precious Metals Corp. (NYSE:WPM) Seasonal Chart

First Quantum Minerals Ltd. (TSE:FM.TO) Seasonal Chart

Interpublic Grp Of Cos (NYSE:IPG) Seasonal Chart

ArcelorMittal SA (NYSE:MT) Seasonal Chart

Teck Resources Ltd. (NYSE:TECK) Seasonal Chart

The Markets

Stocks edged higher on Friday as a rebound in the beaten down energy sector helped to support broader risk sentiment. The S&P 500 Index ended higher by just over a tenth of one percent, still showing a bit of hesitation around psychological resistance at 4500 as near-term buying demand becomes exhausted. The benchmark is increasingly inching towards overbought territory according to the Relative Strength Index (RSI) as price becomes stretched in the near-term, but this is indication of a bullish trend rather than anything to be concerned of over an intermediate-term timeframe. A short-term period of digestion of recent strength is still desirable before we get into the month of December, but, with positive tendencies for stocks persisting through the US Thanksgiving holiday week ahead, pegging when a short-term pullback may occur continues to be a difficult task. Levels of support below the benchmark remain numerous, including the levels of gap support charted in recent weeks, along with major moving averages, keeping the risk-reward on the side of the bulls over an intermediate-term timeframe (eg. through the end of the year).

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The breakout of Technology and Communication Services

- Industrials back above resistance, but industries more enticing than the broader sector exist

- Net assets held by the Fed

- The break of the trend of outperformance of Junk Bonds over Investment Grade Corporate Bonds

- US Housing Starts and the desired exposure in the construction industry

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended slightly bullish at 0.89.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|