Stock Market Outlook for December 4, 2023

S&P 500 Index is back to resistance at the July high, presenting a pivotal point for the market heading into the tax-loss selling period that dominates the first half of December.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Vanguard Mid-Cap Growth ETF (NYSE:VOT) Seasonal Chart

Invesco Trust for Investment Grade Municipals (NYSE:VGM) Seasonal Chart

Teucrium Soybean Fund (NYSE:SOYB) Seasonal Chart

Credit Suisse X-Links Silver Shares Covered Call ETN (NASD:SLVO) Seasonal Chart

iShares Edge MSCI Multifactor Emerging Markets ETF (AMEX:EMGF) Seasonal Chart

SSR Mining Inc. (TSE:SSRM.TO) Seasonal Chart

Canacol Energy Ltd. (TSE:CNE.TO) Seasonal Chart

Edwards Lifesciences Corp. (NYSE:EW) Seasonal Chart

Sasol Ltd. (NYSE:SSL) Seasonal Chart

Whirlpool Corp. (NYSE:WHR) Seasonal Chart

Walgreens Boots Alliance, Inc. (NASD:WBA) Seasonal Chart

Invesco MSCI Global Timber ETF (NYSE:CUT) Seasonal Chart

iShares Core MSCI Emerging Markets IMI Index ETF (TSE:XEC.TO) Seasonal Chart

Canfor Pulp Products Inc. (TSE:CFX.TO) Seasonal Chart

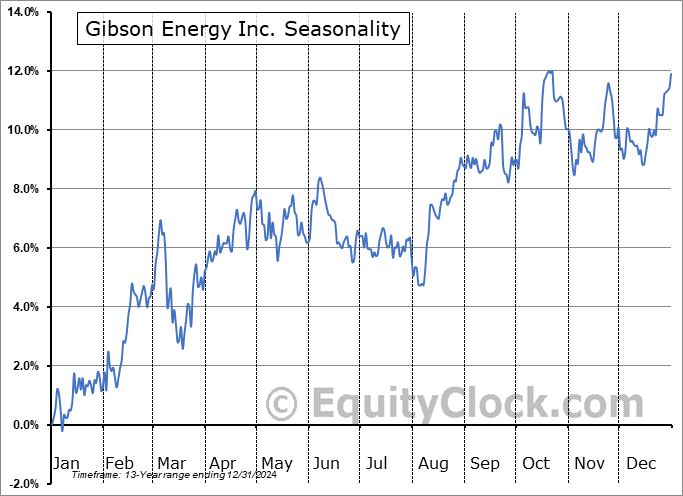

Gibson Energy Inc. (TSE:GEI.TO) Seasonal Chart

Western Forest Products Inc. (TSE:WEF.TO) Seasonal Chart

Finning Intl, Inc. (TSE:FTT.TO) Seasonal Chart

ARK Autonomous Technology & Robotics ETF (AMEX:ARKQ) Seasonal Chart

The Markets

Stocks jumped on Friday as start of the month inflows and a renewed push lower in interest rates gave new life to the market after showing signs of stalling in recent days. The S&P 500 Index ended with a gain of just less than six-tenths of one percent, reaching back to previous resistance at the July high of 4600. The move has given reprieve to the near-term rollover of momentum indicators, which had been pulling back from overbought territory as investors refrained from adding new risk ahead of the traditional tax-loss selling period that spans the first half of December. The Relative Strength Index (RSI) is once again reaching above 70 and the contraction of the MACD histogram has taken a pause. Still, while the break of the recent consolidation range around the 4550 is promising to continue the normal strength in the market that runs through the last couple of months of the year, the near-term risk-reward to adding new equity exposure remains less than ideal at the present time. For our intermediate-term strategy that seasonality encompasses, we are still left with nothing to do and remain fully invested (no cash), whether it be in stocks, bonds, or commodities, a position we have retained since October. We will be looking for our next intermediate-term signal to sell around the end of the year, but, for now, stay the course.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- Rates and the Dollar

- Intermediate Treasury Bond ETF performing on par with the equity market ahead of its period of seasonal strength

- Evidence of indecision on the chart of the US Dollar Index

- Canada Labour Force Survey and the shifting dynamics in the labour market

- US Construction Spending an how to take advantage of the fundamental trends within

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 4

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.85.

Just released…

Our monthly report for December is out, providing you with everything that you need to know heading into the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of December

- Rebound in stocks being fueled by an injection of liquidity in the market

- Near-term headwind to equity prices presented by tax-loss selling

- Market bordering on complacency heading into the end of the year

- The trend of earnings expectations and its impact on equity market direction

- Dollar and rates

- Managed money still holding aggressive short positions in treasury bonds, fueling a short-squeeze

- Pause in Rates Preferred by investors and Preferred Stocks

- Next Phase of Growth over Value

- Bullish Precious Metals and the Miners

- The period of seasonal strength for Oil is directly ahead and the presidential election cycle suggests favourable benefits, as well

- Time to consider inflation hedges for portfolios

- Decline in Industrial production could have implications on next year’s presidential election, if continued

- Consumer showing signs of strain heading into the normally upbeat month of December

- Consumers still not seeing relief in prices of the necessities of life

- Wages taking off again, providing Americans with real growth of their incomes

- Time to rotate to Canadian equities?

- Time to rotate to Small Caps?

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of December

- Notable Stocks and ETFs Entering their Period of Strength in December

Subscribers can look for this 117-page report in their inbox and in the report archive at https://Charts.EquityClock.com

Not subscribed yet? Signup now to receive access to this report and all of the research that we publish.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|