Stock Market Outlook for December 20, 2023

Credit conditions and market liquidity that are the best in 20 months working to support stocks through this seasonally strong time of year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

AmeriServ Financial, Inc. (NASD:ASRV) Seasonal Chart

Cyanotech Corp. (NASD:CYAN) Seasonal Chart

Village Farms International, Inc. (NASD:VFF) Seasonal Chart

SPDR Portfolio S&P 400 Mid Cap ETF (AMEX:SPMD) Seasonal Chart

iShares MSCI China Small-Cap ETF (NYSE:ECNS) Seasonal Chart

Invesco China Technology ETF (NYSE:CQQQ) Seasonal Chart

Ares Management, LP (NYSE:ARES) Seasonal Chart

Beasley Broadcast Group, Inc. (NASD:BBGI) Seasonal Chart

Purecycle Corp. (NASD:PCYO) Seasonal Chart

Global Ship Lease, Inc. (NYSE:GSL) Seasonal Chart

Douglas Emmett Inc. (NYSE:DEI) Seasonal Chart

Enterprise Products Partn (NYSE:EPD) Seasonal Chart

Corning, Inc. (NYSE:GLW) Seasonal Chart

GoldMining, Inc (TSE:GOLD.TO) Seasonal Chart

Corby Spirit and Wine Limited (TSE:CSW/B.TO) Seasonal Chart

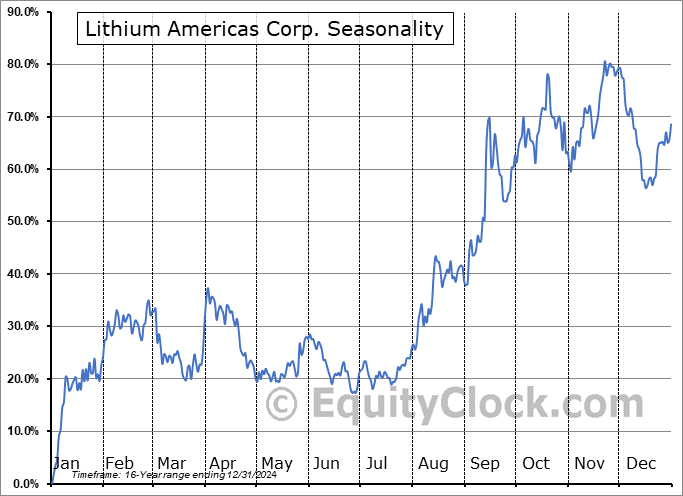

Lithium Americas Corp. (NYSE:LAC) Seasonal Chart

Brookfield Infrastructure Partners L.P. (NYSE:BIP) Seasonal Chart

The Markets

Stocks continued their relentless push higher on Tuesday as portfolio managers chase performance into year end. The S&P 500 Index added nearly six-tenths of one percent, feeling the pull from previous resistance at the all-time high that was charted nearly two years ago at 4800. The benchmark continues to become increasingly overbought with the Relative Strength Index (RSI) now above 82. This is the highest level that this momentum indicator has shown since September of 2020, just prior to a quick 10% correction that played out over a three-week period that followed. There remains a near-term risk of a quick gut-check as buying demand becomes exhausted, but with seasonal tendencies for the market remaining positive into the start of the new year, the likely timeframe to realize this digestion is following the first week of January. The intermediate-term trend of the market, which is the priority in our seasonal process, remains well supported and we are still far away from seeing a topping pattern of significance that would warrant a negative view from a technical perspective. Horizontal resistance at 4800 will be highly scrutinized as it is the last point of reference from a technical perspective until the benchmark gets into clear air in record high territory. Moving averages are all sloped higher with the shorter of the averages hovering above the longer ones, characteristic of a bullish trend.

Today, in our Market Outlook to subscribers, we discuss the following:

- The increasing level of liquidity entering the market and the limit to these flows

- Credit conditions

- US Housing Starts and the exposure to the builders that we desire

- The tendency for housing starts during election years

- Canada Consumer Price Index (CPI)

- Treasury Inflation Protected Securities (TIPS)

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.88.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|