Stock Market Outlook for December 21, 2023

Tax-loss selling may be starting late, but we know which area of the market we want to Avoid while it progresses.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares MSCI Pacific ex Japan ETF (NYSE:EPP) Seasonal Chart

iShares MSCI Malaysia ETF (NYSE:EWM) Seasonal Chart

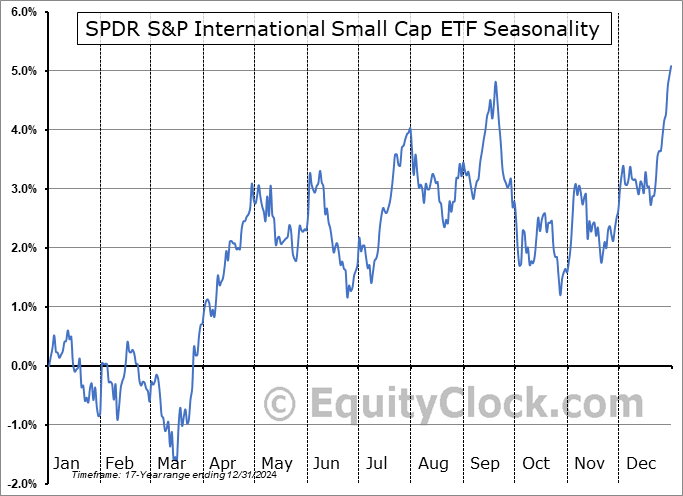

SPDR S&P International Small Cap ETF (NYSE:GWX) Seasonal Chart

GoldMining, Inc. (NYSE:GLDG) Seasonal Chart

International Business Machines (NYSE:IBM) Seasonal Chart

Sunoco LP (NYSE:SUN) Seasonal Chart

Transcontinental Inc. (TSE:TCL/A.TO) Seasonal Chart

Henry Schein, Inc. (NASD:HSIC) Seasonal Chart

Aptose Biosciences Inc. (TSE:APS.TO) Seasonal Chart

StealthGas (NASD:GASS) Seasonal Chart

Suncor Energy, Inc. (NYSE:SU) Seasonal Chart

North American Construction Group Ltd. (NYSE:NOA) Seasonal Chart

The Markets

Stocks reversed early gains on Wednesday as portfolio managers conduct their end-of-year re-balancing before looking to step away from their desks for the holidays in the days ahead. The S&P 500 Index shed 1.47%, showing the largest single session decline since the end of September. The reversal session from gains early in the day to a sharp decline at the closing bell alludes to buying exhaustion, precisely at a time of year when prices typically elevate during the notorious Santa Claus rally period. Near-term risks had been present coming into this timeframe after recording some of the most overbought readings that we have seen in years, making the market vulnerable to a quick gut-check. The Relative Strength Index (RSI) has fallen back below 70 and MACD is showing signs of converging on its signal line, again, both providing compelling sell signals following the significant market rally since the October lows. While this short-term signal leans negative for the market, we currently do not have the trigger from an intermediate/seasonal perspective to suggest abandoning risk, yet, but that could come as soon as the start of next year. Resistance at the all-time high of 4800 warrants ongoing scrutiny.

Today, in our Market Outlook to subscribers, we discuss the following:

- The sharp decline in Consumer Staples and Utilities

- The US Dollar and the rotational strategy that is often effective at the start of the year

- The change we are making in the Super Simple Seasonal Portfolio

- US Existing Home Sales and the changing dynamic that is playing out in the housing market

- Consumer Loan Activity

- The abnormal decline in Business Loans this year

- The change in Margin Debt in investment accounts

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 21

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.83.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|