Stock Market Outlook for January 31, 2024

Stocks, bonds, and commodities are at interesting junctures that could lead to a reshuffling of allocations ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Intl Flavors & Fragrances (NYSE:IFF) Seasonal Chart

Tyson Foods Inc Cl A (NYSE:TSN) Seasonal Chart

DHI Group, Inc. (NYSE:DHX) Seasonal Chart

Invesco Russell 1000 Equal Weight ETF (AMEX:EQAL) Seasonal Chart

iShares Core High Dividend ETF (NYSE:HDV) Seasonal Chart

ProShares Ultra Technology (NYSE:ROM) Seasonal Chart

Ero Copper Corp. (NYSE:ERO) Seasonal Chart

International Money Express, Inc. (NASD:IMXI) Seasonal Chart

The Markets

Stocks closed fairly mixed on Tuesday as technology sector stocks pulled back ahead of the onslaught of big-tech earnings in the days ahead. The S&P 500 Index closed marginally lower by just less than a tenth of one percent, charting a rather indecisive doji candlestick following the prior session’s jump to fresh record highs. The benchmark remains significantly overbought with the Relative Strength Index (RSI) well above 70, a condition that continues to threaten to result in near-term buying exhaustion. From an intermediate-term perspective, from which our seasonal strategy operates, characteristics of a bullish trend remain firmly intact with momentum indicators holding above their middle lines and major moving averages rising alongside one another. This still leaves us will little to do from an equity risk perspective as we look for the next potential opportunity in the market. The psychologically important 5000 level is poised to act as a magnet to the level of the S&P 500 Index until it is achieved, something that could easily be seen through the next couple of weeks amidst the strength that is typical of the first two weeks of February. Only one trading session remains in January and, thus far, the benchmark has managed to persevere through many of the supposed threats that many of the date based studies suggested, such as the performance following a negative Santa Claus Rally period, the performance following a negative first week of the year, and even the sluggish performance that is normal in election years for the first eight to ten weeks of the year. Seasonal tendencies do not suggest any significant downside risks through the first half of February, but the second half is another story, something that we’ll highlight in our monthly report for February.

Today, in our Market Outlook to subscribers, we discuss the following:

- Bond-Stock Ratio

- Commodities showing increasing evidence of support

- Commodities over stocks for the month of February

- Job Openings and Labor Turnover Survey (JOLTS)

- Case-Shiller Home Price Index

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 31

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bullish at 0.91.

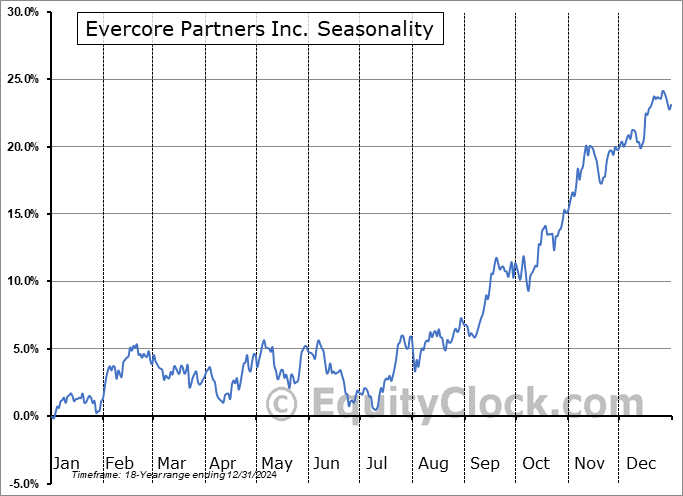

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|