Stock Market Outlook for March 7, 2024

Demand for energy commodities is picking up ahead of the spring and summer driving season, maintaining a bullish bias for the price of Oil and Gas through the months ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Newell Brands Inc. (NASD:NWL) Seasonal Chart

Lululemon Athletica Inc. (NASD:LULU) Seasonal Chart

Gartner Group, Inc. (NYSE:IT) Seasonal Chart

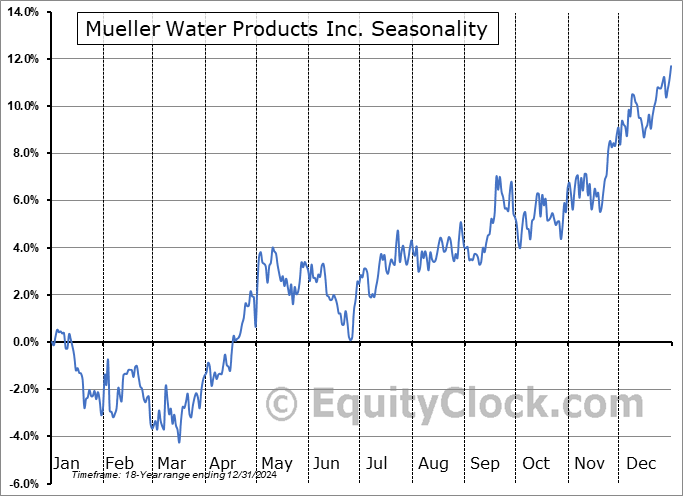

Mueller Water Products Inc. (NYSE:MWA) Seasonal Chart

TransAct Technologies, Inc. (NASD:TACT) Seasonal Chart

Fidelity MSCI Consumer Discretionary Index ETF (AMEX:FDIS) Seasonal Chart

Dell Technologies, Inc. (NYSE:DELL) Seasonal Chart

Y-mAbs Therapeutics, Inc. (NASD:YMAB) Seasonal Chart

Note to subscribers using Gmail:

We have been monitoring inadvertent diversions of our email distributions to the spam folders of Gmail accounts during the past couple of days. The Gmail algorithm is, unfortunately, incorrectly flagging our emails containing our reports and we have been trying to circumvent this by modifying the format of our emails. You should be able to find any distributions that you may be missing in your spam folder. If you can, please specify to Google that our emails are not spam by clicking the relevant button in their platform.

Inadvertent diversions of our content to spam is, unfortunately, a fairly common problem for us given the mention of any number of topics that may be considered “spam worthy,” whether it be referencing digital currencies, banks, pharmaceuticals or other notorious terms that have been used to scam people. Our references to these terms are within the context of our investment research, but yet we are still penalized. Up until now, Gmail has been very good for understanding what our content is, but that appeared to have changed this week. We will continue to monitor and make any efforts that we can to assure that our emails don’t have the characteristics that qualify as a spam email.

Thanks for your understanding.

The Markets

Stocks snapped back, slightly, from Tuesday’s selloff as traders continue to look for rotation candidates in the market amidst the ongoing rising intermediate path of prices. The S&P 500 Index closed higher by just over half of one percent, charting a rather indecisive doji candlestick around the prior session’s downside gap between 5110 and 5129. The more significant of the gaps remains unfilled between 4983 and 5038, acting as a zone to support the market in the short-term as it works to digest the strength in many of the inflated growth sectors that have elevated equity prices to this point. Negative momentum divergences with respect to MACD and RSI highlight the waning buying demand around these heights, but while this lends itself to a near-term pullback, we are far from realizing a breakdown that could have intermediate implications that would have a direct impact on desired equity weightings according to our seasonal approach. Portfolio rebalancing is expected to dominate the market through the month of March before the quarter comes to a close, potentially burdening some of this year’s leaders (eg. technology), while benefiting the laggards (eg. bonds). On the other side of this portfolio rebalance period comes the fund inflows that are notorious in April for the start of the new quarter and contributions to individual retirement accounts (IRA) ahead of the deadline mid-month.

Today, in our Market Outlook to subscribers, we discuss the following:

- Oil/Gas Supply and Demand

- The seasonal trade in the energy sector

- Job Openings and Labor Turnover Survey (JOLTS)

- US Construction Spending and the trade in infrastructure

- The jump in put option volumes into the closing hours of Wednesday’s trade

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for March 7

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bearish at 1.05.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|