Stock Market Outlook for March 20, 2024

Home builders are no longer running down their land inventory as they start to express optimism of future conditions. The companies that produce the inputs that go into home construction are poised to benefit.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

F&C Claymore Preferred Securities Income Fund (NYSE:FFC) Seasonal Chart

RBC Bearings Inc. (NYSE:RBC) Seasonal Chart

K92 Mining Inc. (TSE:KNT.TO) Seasonal Chart

Snap On Inc. Holding Co. (NYSE:SNA) Seasonal Chart

Wells Fargo Advantage Utilities & High Income Fund (AMEX:ERH) Seasonal Chart

Invesco S&P Spin-Off ETF (NYSE:CSD) Seasonal Chart

Great Ajax Corp. (NYSE:AJX) Seasonal Chart

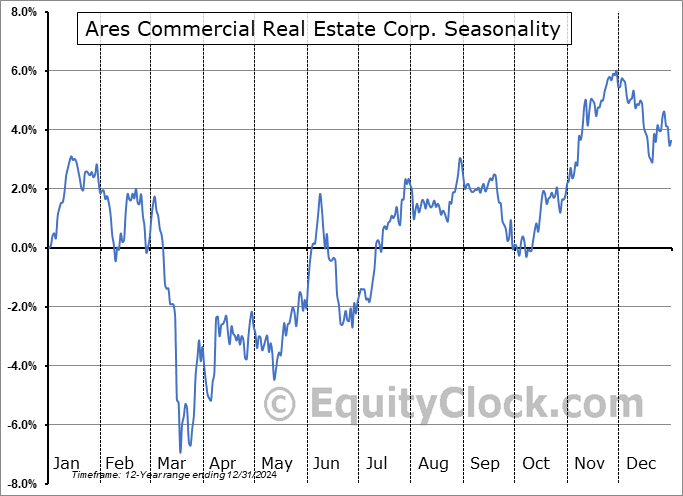

Ares Commercial Real Estate Corp. (NYSE:ACRE) Seasonal Chart

Sabine Royalty Trust (NYSE:SBR) Seasonal Chart

KBR Inc. (NYSE:KBR) Seasonal Chart

North West Co. Inc. (TSE:NWC.TO) Seasonal Chart

Precision Drilling Corp. (TSE:PD.TO) Seasonal Chart

The Markets

Stocks just don’t know when to give up. The S&P 500 Index rose for a second day ahead of the FOMC announcement on Wednesday to produce a gain of just over half of one percent. Short-term resistance below 5200 remains apparent as buying momentum in the market wanes around these heights, something that the negative divergences with respect to MACD and RSI have been portraying for some time. Short-term support remains well defined at the rising 20-day moving average, now at 5112. Wednesday’s Fed event will be key to the short-term path of the benchmark, either confirming the level of short-term resistance overhead or confirming the level of short-term support. A recent upward drift in yields and the dollar are suggesting that investors may be preparing for a hawkish tilt when the Fed concludes its two-day meeting.

Today, in our Market Outlook to subscribers, we discuss the following:

- Equity market breadth

- The breakout of the NYSE Cumulative Advance-Decline Volume line

- US Housing Starts

- Signs of optimism among the builders and how to play it

- Construction stocks

- Canada Consumer Price Index (CPI)

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for March 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at neutral at 0.99.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|