Stock Market Outlook for April 2, 2024

Defensive sectors have been seen breaking levels of significant resistance, but we are still far away from observing signs of risk-aversion that would indicate investors positioning for a negative outcome in the market ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Merck & Co., Inc. (NYSE:MRK) Seasonal Chart

Liquidity Services Inc. (NASD:LQDT) Seasonal Chart

Great Lakes Dredge & Dock Corp. (NASD:GLDD) Seasonal Chart

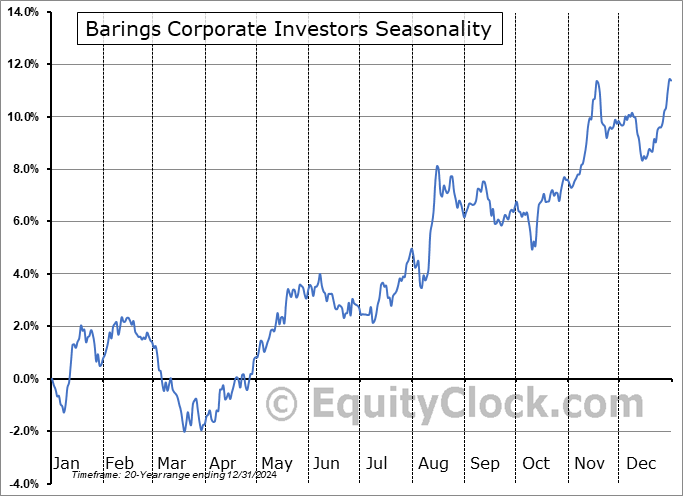

Barings Corporate Investors (NYSE:MCI) Seasonal Chart

Pennant Park Floating Rate Capital Ltd (NYSE:PFLT) Seasonal Chart

The Markets

Stocks softened slightly on Monday amidst a spike in the cost of borrowing following comments from Fed Chair Jerome Powell on Friday that alluded to the central bank not being in a rush to cut rates. The S&P 500 Index slipped by two-tenths of one percent, peeling back from the all-time intraday high that was charted on Friday at 5264. A very short-term double-top around this hurdle can be picked out on the hourly chart; previous horizontal resistance at 5185 is in a position of support. The market remains solid above its 20-day moving average (5175), a variable hurdle that has supported the grind higher in prices this year. Evidence buying exhaustion persists with momentum indicators negatively diverging from price, but this has yet to break the characteristics of a bullish intermediate-term (multi-month) trend that remains well ingrained on the chart. Despite the decline to start the month and the quarter, the market is still setup well to realize the strength and rotation that is normal for the month of April, barring some catalyst to the contrary.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our Weekly Chart Books Update, along with our list of all segments of the market to either Accumulate or Avoid

- Evidence of risk aversion in the market is absent as High Beta breaks out

- Computer Hardware industry and the significant topping pattern on Apple (AAPL)

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 2

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Monday, as gauged by the put-call ratio, ended slightly bullish at 0.91.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|