Stock Market Outlook for April 24, 2024

The Consumer Discretionary sector is within a long-term trend of underperformance versus the market, a pattern that was last seen in the run-up to the Great Financial Crisis.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Stepan Co. (NYSE:SCL) Seasonal Chart

Welltower Inc. (NYSE:WELL) Seasonal Chart

Minerva Neurosciences, Inc. (NASD:NERV) Seasonal Chart

Aspen Aerogels, Inc. (NYSE:ASPN) Seasonal Chart

Meta Platforms, Inc. (NASD:META) Seasonal Chart

Open Lending Corp (NASD:LPRO) Seasonal Chart

The Markets

Stocks rallied for a second day as traders prepare for the onslaught of earnings reports to be released in the days/weeks ahead. The S&P 500 Index closed with a gain of 1.20%, continuing to move higher from support at its 100-day (20-week) moving average around 4944. Momentum indicators continue to curl higher from their slide that has played out over the past few weeks, moving back towards the midpoint of their ranges that act as the dividing line between bullish and bearish trends. Resistance can be pegged at the declining 20-day moving average (5140), a level that we alluded to last week as warranting scrutiny for signs of upside exhaustion given the apparent transition towards risk aversion that has materialized. The intermediate-term path of the benchmark remains that of higher-highs and higher-lows, warranting a bullish bias, for now, but should evidence materialize that this is no longer the path of least resistance, buckling up for the volatility that is normal of the late spring/summer will be appropriate. Just a week and a half remains in the best six month of the year timeframe for stocks, a period that, this year, has produced one of the best performances in the past 25 years with the S&P 500 higher by over 20% since the end of last October. Seasonal investors are certainly exiting the strongest half of the year for stocks with significant profits in hand and we could be setting up for the normal digestive/sluggish period ahead that runs through the next six months.

Today, in our Market Outlook to subscribers, we discuss the following:

- US New Home Sales

- The below average trend of consumer loan activity

- Consumers continuing to rely on credit cards to bridge the hole in their finances

- Visa Spending Momentum Index

- The long-term trend of underperformance of the Consumer Discretionary sector

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 24

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bearish at 1.04.

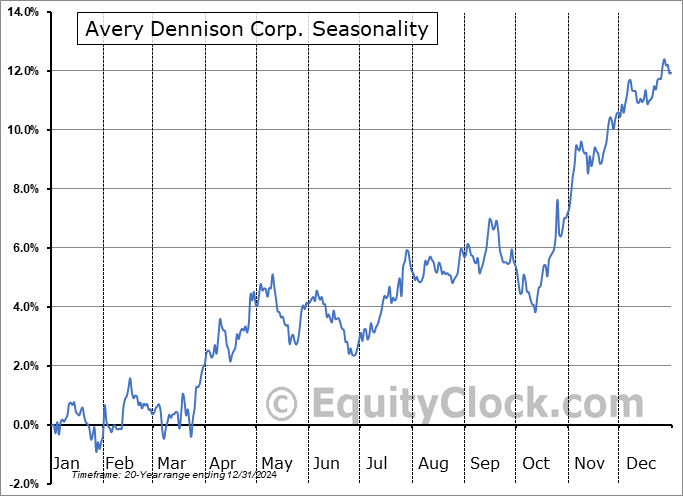

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|