Stock Market Outlook for April 29, 2024

The fuel source to the prevailing intermediate-term rising trend of stocks may have been turned off in recent weeks, but it is not yet depleted.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Charter Communications Inc. (NASD:CHTR) Seasonal Chart

Northern Technologies Intl Corp. (NASD:NTIC) Seasonal Chart

eXp World Holdings Inc. (NASD:EXPI) Seasonal Chart

Blackrock Silver Corp. (TSXV:BRC.V) Seasonal Chart

Tech Leaders Income ETF (TSE:TLF.TO) Seasonal Chart

Roku, Inc. (NASD:ROKU) Seasonal Chart

Spotify Technology S.A. (NYSE:SPOT) Seasonal Chart

The Markets

Stocks rallied on Friday as an upbeat reaction to earnings from Alphabet (Google) alleviated concerns pertaining to the technology sector that the market was expressing just one session earlier. The S&P 500 Index closed with a gain of 1.02%, reaching up and testing short-term resistance at the declining 20-day moving average at 5116. Support remains evident at the 100-day (20-week) moving average, presently hovering around 4959. The downside gap that was charted on Thursday between 5020 and 5058 has been closed and now an upside gap between 5057 and 5073 has been opened, providing a point of short-term support in the near-term. Momentum indicators are reaching up to their middle lines, trying to avoid the adoption of characteristics of a bearish trend that would be defined by a prolonged period in the bottom half of their ranges. Just one week remains in the best six month timeframe for stocks and, as of Friday, the large-cap benchmark is higher by 23.86% for this favourable timeframe, representing the second best performance for this risk-on period for stocks in the past two decades. While the returns for the six months that follow are typically lacklustre by comparison, the universe of results for this timeframe suggest that it is normally not negative, although volatility is certainly commonplace, providing opportunities to both bullish and bearish camps. Our list of Accumulate and Avoid candidates will help to keep you on track with whatever category of investor you desire to be through this off-season that gets underway following the first week of May.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The decline in market liquidity over the past few weeks and the fuel source for stocks to continue their bullish trend

- Active Investment Manager Exposure to stocks

- Margin Debt and Credit Balances in investor accounts

- The slide deck to our Canadian Association of Technical Analysts (CATA) presentation on the topic of Using Seasonality to Find Investment Opportunities

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 29

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended slightly bearish at 1.01.

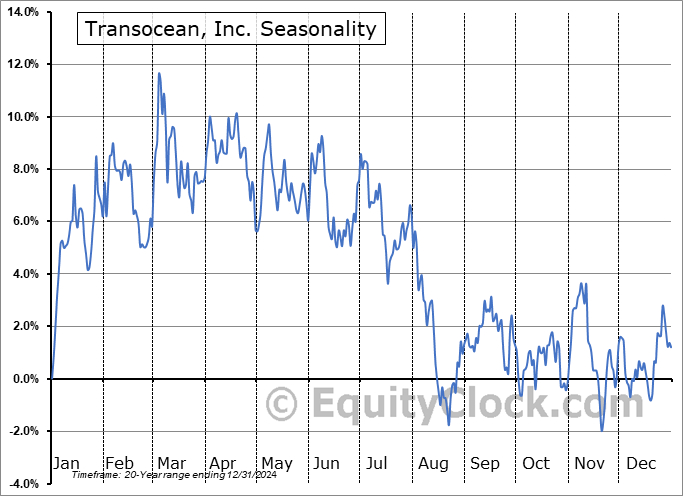

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|