Stock Market Outlook for May 21, 2024

The energy sector may have pulled back in recent weeks, but the fundamental, technical, and seasonal paths remain conducive to further gains through the weeks ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Greene County Bancorp, Inc. (NASD:GCBC) Seasonal Chart

iShares Morningstar Large-Cap Growth ETF (NYSE:ILCG) Seasonal Chart

Vanguard Growth ETF (NYSE:VUG) Seasonal Chart

Chegg, Inc. (NYSE:CHGG) Seasonal Chart

Cascades, Inc. (TSE:CAS.TO) Seasonal Chart

Altus Group Ltd. (TSE:AIF.TO) Seasonal Chart

Lindsay Corp. (NYSE:LNN) Seasonal Chart

Tesla Inc. (NASD:TSLA) Seasonal Chart

Invesco QQQ Trust (NASD:QQQ) Seasonal Chart

Vanguard Russell 1000 Growth ETF (NASD:VONG) Seasonal Chart

Alexandria R E Eqty, Inc. (NYSE:ARE) Seasonal Chart

iShares NASDAQ 100 Index ETF (CAD-Hedged) (TSE:XQQ.TO) Seasonal Chart

SPDR S&P 500 Growth ETF (NYSE:SPYG) Seasonal Chart

Amplify Transformational Data Sharing ETF (AMEX:BLOK) Seasonal Chart

Note: Monday is holiday in Canada (Victoria Day) and, as a result, our next report to subscribers will be released on Tuesday. Our weekly chart books will be updated, as per usual, on Sunday and will be available for download in the archive, but the commentary regarding the updates will be released on Tuesday. Have a great weekend everyone!

The Markets

Stocks closed mixed to end the week as traders contemplate the next move now that major equity benchmarks are back in all-time high territory. The S&P 500 Index closed with a gain of just over one-tenth of one percent, seemingly holding within a very tight short-term range above previous resistance at the March high of 5264. The 20-day moving average (5151) is in the process of intersecting again with the 50-day moving average (5157), an event that, if realized, would further confirm the intermediate-term positive trajectory that the benchmark remains. The rising 100-day moving average (5037) continues to underpin the trend of higher-highs and higher-lows, warranting a bullish bias in seasonal positions until levels of resistance become more important to the market than levels of support. Momentum indicators are all firmly above their middle lines, showing characteristics of a bullish trend. The off-season for stocks that starts at the beginning of May has not proven to be much of a headwind for stocks, yet, and now the next short-term period of positivity is upon us as we head into the days surrounding the Memorial Day holiday. While the Relative Strength Index (RSI) is bordering on overbought territory, it would be difficult to argue that prices are stretched here given the correction that has taken place over the past month, perhaps front-running the normal weakness that plays out through the middle of May.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- Energy demand and supply

- The seasonal trade in the energy sector

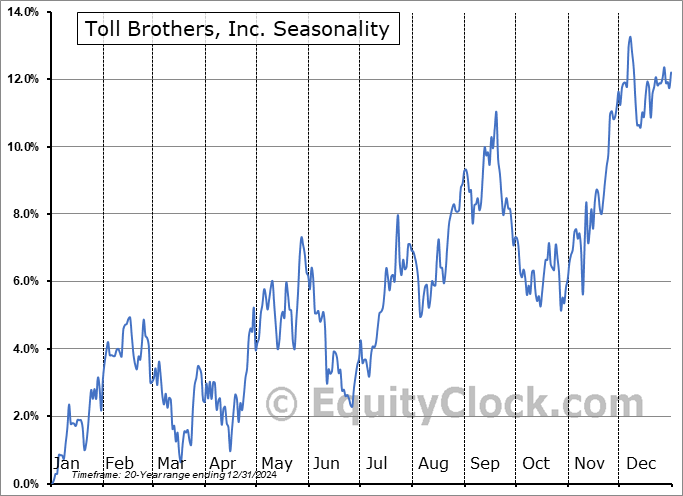

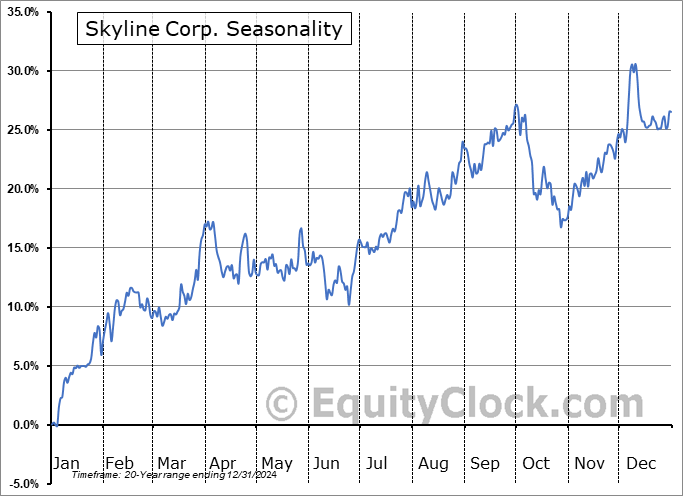

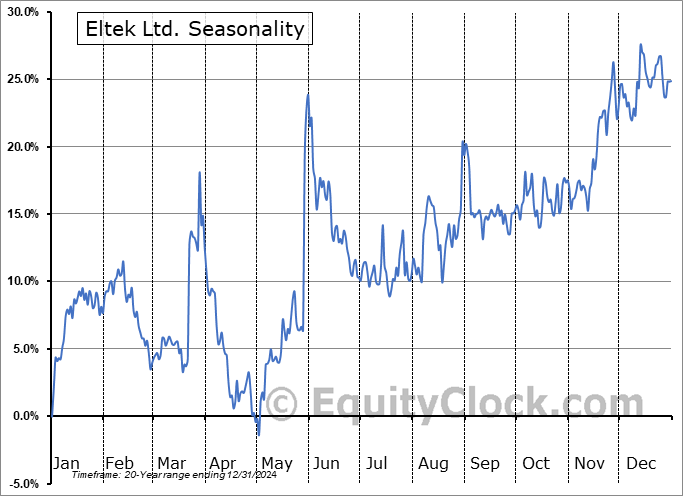

- US Housing Starts and the preferred investments to take advantage of the fundamental trend that is materializing

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 21

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.83.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|