Stock Market Outlook for June 12, 2024

The US Dollar Index warrants scrutiny through the days ahead as a positive tilt continues to evolve, providing a headwind to broader equity prices.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

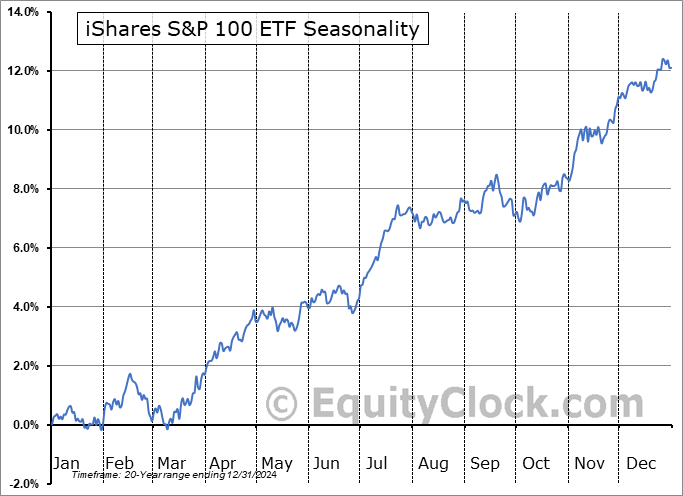

iShares S&P 100 ETF (NYSE:OEF) Seasonal Chart

The Markets

Stocks are remaining relentless amidst the recent run of risk-aversion as traders seek refuge in core-defense and growth (technology) segments of the market. The S&P 500 Index added another quarter of one percent, starting to show a grind higher above recently retaken support at the 20-day moving average (5305). The rising 50-day moving average (5195) remains the hurdle that is buoying the broad benchmark, allowing traders to peg their stops on long allocations against the variable level. Momentum indicators continue to show a diverging trend versus price, a sign of the lack of broad buying demand around these record heights, but so long as traders can find individual names that are working and that have a dominant influence on the broad benchmark performance, it is difficult to keep this market gauge capped similar to what core-cyclical sectors of the market are showing. Seasonal tendencies continue to call for weakness in the near-term before we get into the summer rally timeframe in July with one of the weakest timeframes of the year normally realized between June 14th and June 27th (see our Market Outlook for June). We continue to lack the desire to be aggressive in equity exposure in the near-term during this downbeat period that is at our doorstep.

Today, in our Market Outlook to subscribers, we discuss the following:

- The breakout of Apple (AAPL)

- US Dollar Index

- Euro

- The topping pattern on the chart of the Financial sector and the Insurance industry

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for June 12

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bullish at 0.87.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|