Stock Market Outlook for July 31, 2024

Volatility hedges are in demand, outperforming the broader market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

United Rentals, Inc. (NYSE:URI) Seasonal Chart

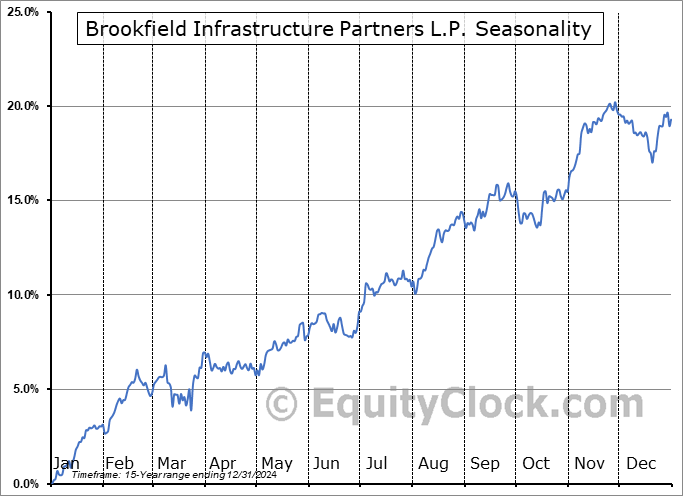

Brookfield Infrastructure Partners L.P. (TSE:BIP/UN.TO) Seasonal Chart

ASGN Inc. (NYSE:ASGN) Seasonal Chart

BMO US Put Write ETF (TSE:ZPW.TO) Seasonal Chart

The Markets

Stocks closed fairly mixed on Tuesday in a rather volatile session as traders await earnings and the FOMC announcement in the days ahead. The large-cap benchmark closed with a loss of half of one percent, closing right around the 50-day moving average (5442), a rather neutral position ahead of the uncertain events to come. Gap resistance remains overhead between 5508 and 5550, just one of multiple layers that are in a position to cap the benchmark as we get further into the period of volatility for stocks in August, September, and October. The 20-day moving average (5541) has started to rollover, providing another hurdle on the upside that is in a position to cap the benchmark in the near-term. MACD is dipping negative, joining the Relative Strength Index (RSI) below the mid-point of their ranges as the momentum indicators start to lose their characteristics of a bullish trend. Defensive assets and volatility hedges are certainly preferred at this time of year.

Today, in our Market Outlook to subscribers, we discuss the following:

- Intermediate-term treasury bonds

- Dividend stocks

- Job Openings and Labor Turnover Survey (JOLTS)

- US Home Prices

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 31

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bearish at 1.04.

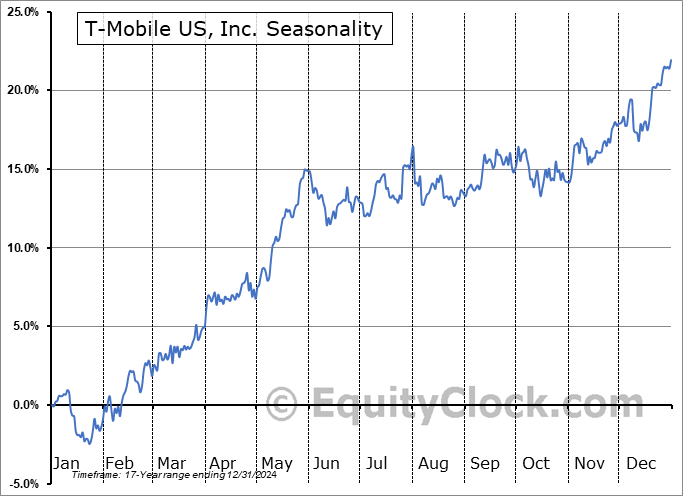

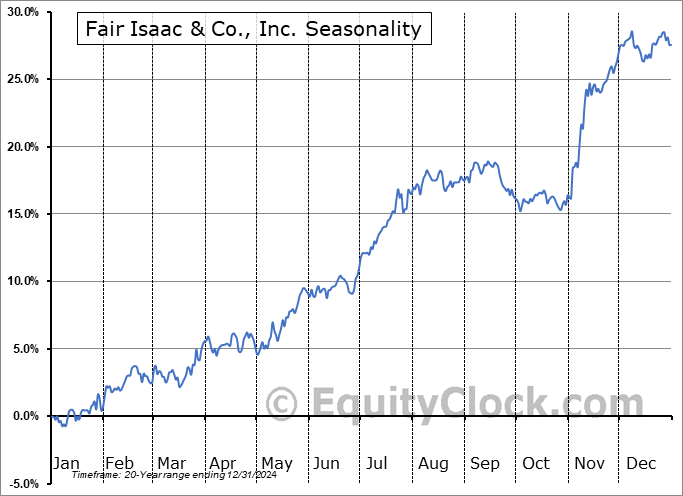

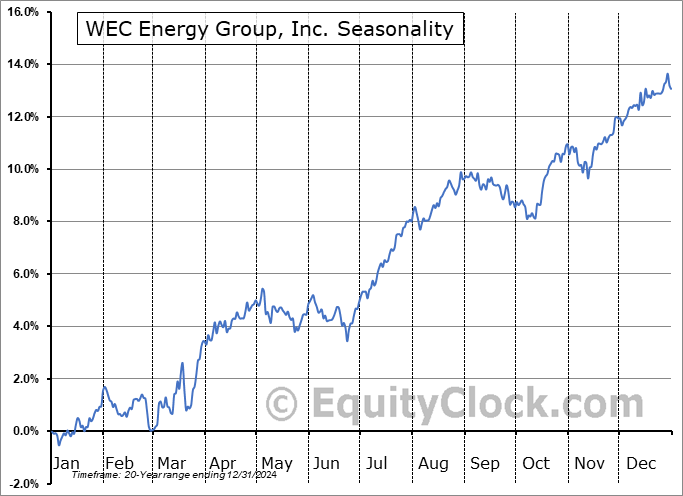

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|