Stock Market Outlook for September 18, 2024

The more discerning consumer mentality has been observed injecting product into inventories in one of the most significant ways on record.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Brady Corp. (NYSE:BRC) Seasonal Chart

Transportadora De Gas Sur (NYSE:TGS) Seasonal Chart

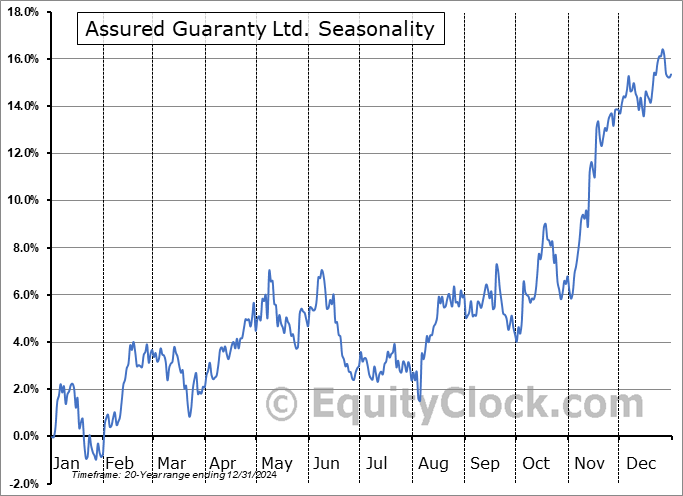

Assured Guaranty Ltd. (NYSE:AGO) Seasonal Chart

Telecom Argentina (NYSE:TEO) Seasonal Chart

The Markets

Stocks closed little changed on Tuesday as investor await the outcome of the FOMC decision that is slated to be released on Wednesday. The S&P 500 Index ended higher by a mere three basis points (0.03%) after touching a fresh all-time high and puncturing horizontal resistance at 5650 intraday. The result is a doji indecision candlestick ahead of the uncertain market moving event. Again, the strength in the market over the past seven trading sessions continues to skew the look of the intermediate-term topping pattern that was charted from the recent rollover below the mid-July (summer rally) peak, however, the weakest part of September is still ahead, running through the last couple of weeks of the month. It remains difficult is this seasonal framework to signal the all-clear to entertain a more risk-on perspective to portfolio allocations in the very near-term (next couple of weeks). The technical backdrop no longer lends itself to a bearish outcome as a base-case scenario, but, abiding by a strategy that requires the three prongs to our approach (seasonal, technical, and fundamental) to align, we are certainly not excited about broad equity market allocations at this time. Investments denoted as Accumulate candidates in our chart books continue to work very well, while those indicated as ones to Avoid will obviously warrant scrutiny through the weeks ahead as we progress through this period of seasonal volatility for stocks and as the best six months of the year timeframe nears. The hurdles to watch for a directional bias for the intermediate-term trend remain support at the 100-day/20-week moving average (5416) and downside gap resistance between 5622 and 5658; a break of either would likely continue the near-term direction of travel, either higher or lower. Until then, a narrowing consolidation span is the pattern.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Retail Sales

- The pronounced rise in retailer inventories

- US Industrial Production

- The impact on the Presidential Election should industrial production lag the seasonal norm heading into Election Day

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 18

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.71.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|