Stock Market Outlook for September 23, 2024

Dow Theory is failing to confirm the new highs and bullish trend in many of the broad market benchmarks given the capped performance of transportation stocks from the past few years.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Kroger Co. (NYSE:KR) Seasonal Chart

DENTSPLY Intl Inc. (NASD:XRAY) Seasonal Chart

Advance Auto Parts Inc. (NYSE:AAP) Seasonal Chart

Plexus Corp. (NASD:PLXS) Seasonal Chart

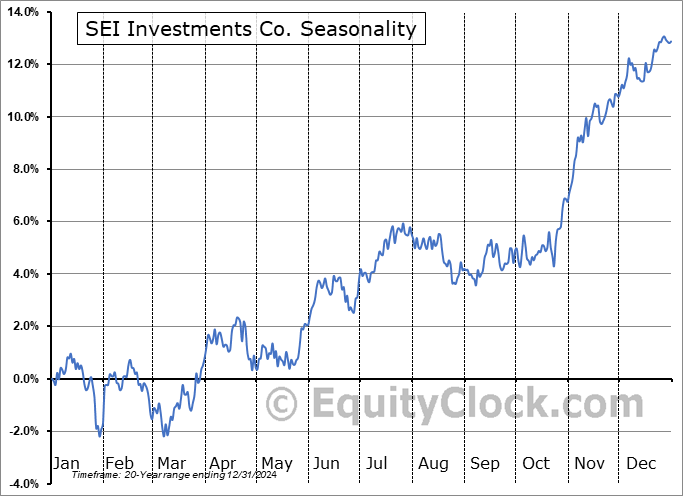

SEI Investments Co. (NASD:SEIC) Seasonal Chart

NetGear, Inc. (NASD:NTGR) Seasonal Chart

Check Point Software Technologies, Ltd. (NASD:CHKP) Seasonal Chart

Globe Life Inc. (NYSE:GL) Seasonal Chart

iShares U.S. Basic Materials ETF (NYSE:IYM) Seasonal Chart

Tri Pointe Homes Inc. (NYSE:TPH) Seasonal Chart

Coca-Cola Consolidated, Inc. (NASD:COKE) Seasonal Chart

The Markets

Stocks closed little changed to end the week as market held onto the strength attributed to the Fed’s unexpected move to cut rates by an outsized 50 basis points on Wednesday. The S&P 500 Index shed a mere two-tenths of one percent, remaining above horizontal resistance that was broken on Thursday at 5650. Support remains well defined at the 100-day moving average (5434). The technicals suggest the continuation of the near-term direction of travel, which is higher, despite being within this weak time of year for equity market performance at the end of the second quarter. Seasonality has us locked into this cautious view of stocks through the remaining days of September, but the strength that the market has been revealing certainly diminishes the threat of an intermediate-term topping pattern that was apparent previous.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- CASS Freight Index

- Delivery Services industry and the downfall of shares of FedEx (FDX)

- Dow Theory

- Canadian Retail Sales

- Canada Consumer Price Index (CPI)

- The technicals of the Canadian Dollar and other currencies around the globe

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended slightly bullish at 0.89.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|