Stock Market Outlook for October 11, 2024

Initial Claims just jumped to the highest level for October since the period following on the onset of pandemic restrictions in 2020 and 2021.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

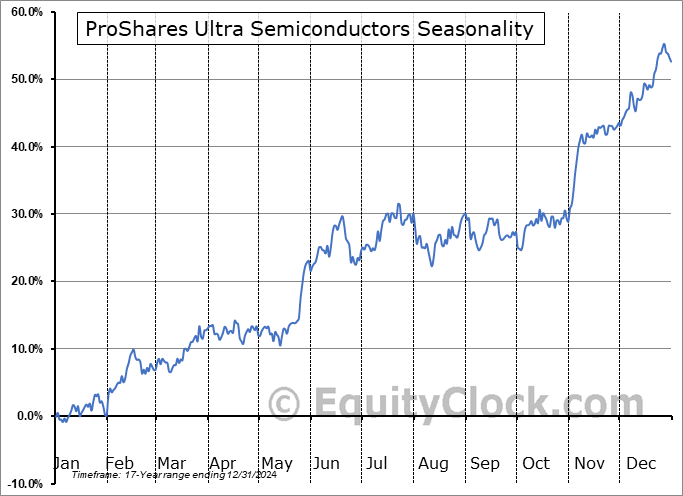

ProShares Ultra Semiconductors (NYSE:USD) Seasonal Chart

Sonos Inc. (NASD:SONO) Seasonal Chart

Farfetch Ltd. (NYSE:FTCH) Seasonal Chart

Axon Enterprise, Inc. (NASD:AXON) Seasonal Chart

Consumer Portfolio Services, Inc. (NASD:CPSS) Seasonal Chart

Biogen Inc. (NASD:BIIB) Seasonal Chart

Ambarella, Inc. (NASD:AMBA) Seasonal Chart

ASML Holding NV (NASD:ASML) Seasonal Chart

ManpowerGroup (NYSE:MAN) Seasonal Chart

Morgan Stanley (NYSE:MS) Seasonal Chart

Essential Utilities, Inc. (NYSE:WTRG) Seasonal Chart

Cencora Inc. (NYSE:COR) Seasonal Chart

Invesco KBW Bank ETF (NASD:KBWB) Seasonal Chart

Mistras Group Inc. (NYSE:MG) Seasonal Chart

Hudson Pacific Properties Inc. (NYSE:HPP) Seasonal Chart

Synaptics, Inc. (NASD:SYNA) Seasonal Chart

Seagate Technology Holdings, Inc. (NASD:STX) Seasonal Chart

The Markets

Stocks dipped slightly on Thursday as a spike in jobless claims and a hotter than expected read of inflationary pressures in the economy had traders pulling back on risk. The S&P 500 Index closed lower by just over two-tenths one percent, remaining within arm’s reach of the all-time high that was charted in the previous session. Support has been maintained at previous resistance of 5669, along with the 20-day moving average that is presently hovering around the same level, keeping the positive trajectory intact. Despite evidence of waning upside momentum within this tail-end to the period of seasonal volatility for stocks, this market is showing greater evidence of support than resistance, a characteristic of a bullish trend. We continue to like the groups that are on our list of Accumulate candidates and there are certainly segments of the market to Avoid. The ability of the market as a whole to overcome the period of seasonal weakness for stocks rather unscathed is certainly telling of the relentless demand, despite the fact that the risk-reward, broadly, is not very attractive. The start of the best six months of the year for stocks is now just three weeks away and there is a need from a seasonal perspective to ramp up risk exposure at some point.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly Jobless Claims and the health of the labor market

- US Consumer Price Index (CPI) and the investment implications within

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 11

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.86.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|