Stock Market Outlook for October 15, 2024

The services economy is holding up well, even as demand for goods struggles.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

James Hardie Industries NV (NYSE:JHX) Seasonal Chart

nVent Electric plc. (NYSE:NVT) Seasonal Chart

Inspire Medical Systems, Inc. (NYSE:INSP) Seasonal Chart

Burlington Stores, Inc. (NYSE:BURL) Seasonal Chart

Hollysys Automation Technologies, Ltd. (NASD:HOLI) Seasonal Chart

Hawaiian Holdings, Inc. (NASD:HA) Seasonal Chart

Werner Enterprises, Inc. (NASD:WERN) Seasonal Chart

Sally Beauty Holdings Inc. (NYSE:SBH) Seasonal Chart

Walgreens Boots Alliance, Inc. (NASD:WBA) Seasonal Chart

TJX Cos., Inc. (NYSE:TJX) Seasonal Chart

Robert Half Intl, Inc. (NYSE:RHI) Seasonal Chart

Keycorp (NYSE:KEY) Seasonal Chart

Emerson Electric Co. (NYSE:EMR) Seasonal Chart

iShares U.S. Infrastructure ETF (AMEX:IFRA) Seasonal Chart

iShares Global Real Estate Index ETF (TSE:CGR.TO) Seasonal Chart

Stantec, Inc. (TSE:STN.TO) Seasonal Chart

Wesco Intl, Inc. (NYSE:WCC) Seasonal Chart

PetMed Express, Inc. (NASD:PETS) Seasonal Chart

NetScout Systems, Inc. (NASD:NTCT) Seasonal Chart

Invesco S&P 100 Equal Weight ETF (AMEX:EQWL) Seasonal Chart

3M Co. (NYSE:MMM) Seasonal Chart

Nordson Corp. (NASD:NDSN) Seasonal Chart

Steel Dynamics, Inc. (NASD:STLD) Seasonal Chart

Toromont Industries Ltd. (TSE:TIH.TO) Seasonal Chart

PNC Financial Services Gr (NYSE:PNC) Seasonal Chart

Note: Monday is a stat holiday in Canada (Thanksgiving) and, as a result, our next Market Outlook report will be provided on Tuesday. We will be updating our Weekly Chart Books on schedule on Sunday, but commentary pertaining any ratings changes will be released on Tuesday. If you are celebrating Thanksgiving in Canada or Columbus Day in the US, enjoy the long weekend!

The Markets

Stocks rallied on Friday as positive reaction to earnings from some of the major banks pushed major equity benchmarks to new heights. The S&P 500 Index closed higher by just over six-tenths one percent, charting a fresh record closing high. Support has been maintained at previous resistance of 5669, along with the 20-day moving average that is presently hovering around the same level, keeping the positive trajectory intact. Despite evidence of waning upside momentum within this tail-end to the period of seasonal volatility for stocks, this market is showing greater evidence of support than resistance, a characteristic of a bullish trend. We continue to like the groups that are on our list of Accumulate candidates, but there are certainly segments of the market to Avoid. The ability of the market as a whole to overcome the period of seasonal weakness for stocks rather unscathed is certainly telling of the relentless demand, despite the fact that the risk-reward, broadly, is not very attractive. The start of the best six months of the year for stocks is now just three weeks away and there is a need from a seasonal perspective to ramp up risk exposure at some point.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

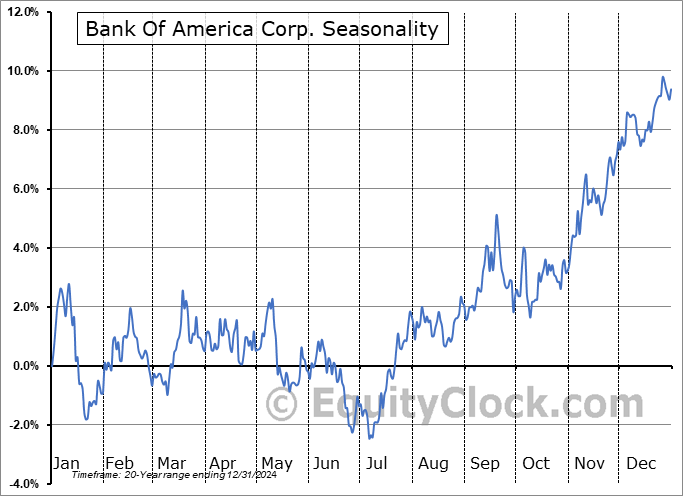

- Bank stocks

- Canada Labour Force Survey

- The second strongest rise in Canadian unemployment for a non-recessionary period through the first three-quarters of the year on record

- US Producer Price Index (PPI)

- The bond market as it looks to exit its short-term period of seasonal weakness

- Interest rate sensitive sectors

- Gold and Gold Miners

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 15

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended slightly bullish at 0.93.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|