Stock Market Outlook for November 4, 2024

Despite the weak payroll report for October, the bond market sold off surprisingly hard, resulting in a break of rising trendline support on the Aggregate Bond Fund.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Arista Networks, Inc. (NYSE:ANET) Seasonal Chart

Invesco MSCI Global Timber ETF (NYSE:CUT) Seasonal Chart

Analog Devices, Inc. (NASD:ADI) Seasonal Chart

Pizza Pizza Royalty Corp. (TSE:PZA.TO) Seasonal Chart

Uranium Energy Corp. (AMEX:UEC) Seasonal Chart

Mercer Intl, Inc. (NASD:MERC) Seasonal Chart

Winnebago Industries Inc. (NYSE:WGO) Seasonal Chart

Masco Corp. (NYSE:MAS) Seasonal Chart

Fiserv, Inc. (NYSE:FI) Seasonal Chart

SPDR S&P Homebuilders ETF (NYSE:XHB) Seasonal Chart

L3Harris Technologies Inc. (NYSE:LHX) Seasonal Chart

Penn National Gaming, Inc. (NASD:PENN) Seasonal Chart

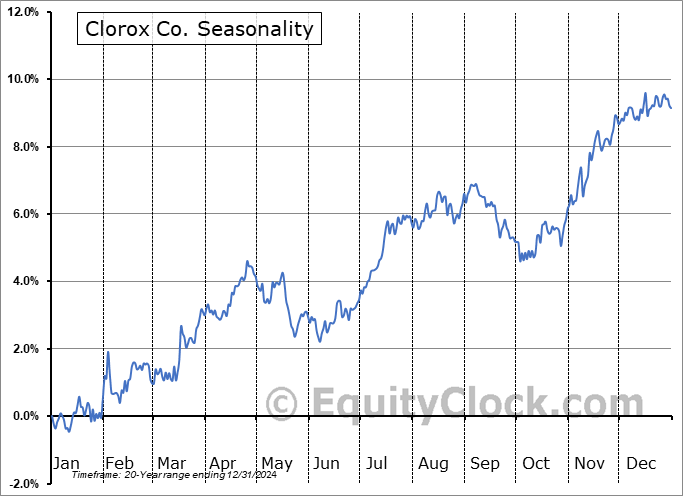

Clorox Co. (NYSE:CLX) Seasonal Chart

Lockheed Martin Corp. (NYSE:LMT) Seasonal Chart

The Markets

Stocks rebounded slightly from Thursday’s selloff as strength in the consumer discretionary sector as a result of a positive reaction to earnings from Amazon (AMZN) helped the market to mitigate the pressures stemming from the rise in interest rates and the US Dollar. The S&P 500 Index closed higher by just over four-tenths of one percent, remaining below the 20-day moving average (5804) that was broken in the prior session. A level of resistance remains in place between Thursday’s open at 5775 and Wednesday’s close at 5816. The short-term trend can been deemed to be negative as investors show caution ahead of election day. Support will be scrutinized around the 50-day moving average (5701) to determine if it can break the benchmark out of this short-term slump. Despite the recent stall, this market is not showing any broader topping setups and there remains greater evidence of support than resistance over an intermediate-term timeframe, presenting characteristics of a bullish trend that remains enticing for the positive seasonal tendencies ahead. The concern to the prevailing path, however, is the waning of upside momentum with MACD negatively diverging from price since the end of last year, highlighting the fading enthusiasm towards the risk profile that equities encompass. The risk-reward, broadly, remains unattractive, but this pullback should provide us with an entry point to the strength that is normal of the equity market through the last couple of months of the year. We continue to like the groups that are on our list of Accumulate candidates, but there are certainly segments of the market to Avoid. With the start of the best six months of the year for stocks slated to get underway, we will be seeking to use weakness to ramp up risk exposure, preferably when metrics of volatility/fear alleviate their rising path that has evolved over the past few months (see our commentary of the Volatility Index (VIX) in our November monthly report).

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- US Employment Situation and the investment implications within

- Bond market breaking rising trendline support

- Investor Sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 4

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bearish at 1.16.

Just Released…

Our monthly report for November is out, providing you with everything that you need to know to navigate the market through the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of November

- VIX remaining elevated heading into the strongest time of the year for stocks

- Dollar, Yields, and Stocks

- Existing Home Sales

- Seasonal trade in the Homebuilding industry

- Consumers refraining from taking out loans

- Weak loan activity, but strong credit market

- Hope that interest rates will invigorate waning economic activity may be premature

- Earnings Per Share (EPS) still expected to grow, but the trajectory of the change is waning

- No evidence that the rise in interest rates weighed on market valuations, as we have seen in the past

- How “on point” analysts are presently with their expectations

- Largest September decline in Retail Sales in five years

- Second strongest percentage increase in retailer inventories in decades

- Spending momentum highly depressed heading into the end of the year

- Longest trend of underperformance for the consumer discretionary sector since the years prior to the Great Financial Crisis

- Retail stocks stuck heading into the holiday season

- Boeing strike weighing heavy on Industrial Production and it is likely to get worse before it gets better

- The historical impact of a weaker than average trend of Industrial Production on the Presidential Election

- Precious Metals shining bright

- Still “healthy” fundamental trends in Health Care

- Peak of equity market buying demand

- Investor enthusiasm towards stocks waning

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of November

- Notable Stocks and ETFs Entering their Period of Strength in November

Subscribers can look for this 126-page report in their inbox and in the report archive.

Not subscribed yet? Signup now to receive access to this report and all of the research that we publish.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|