Stock Market Outlook for December 6, 2024

Bitcoin has crossed above $100,000, but we have our eye on another cryptocurrency as a better bet through the months ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Merus BV (NASD:MRUS) Seasonal Chart

Alphamin Resources Corp. (TSXV:AFM.V) Seasonal Chart

Trigon Metals Inc. (TSXV:TM.V) Seasonal Chart

Fury Gold Mines Ltd. (TSE:FURY.TO) Seasonal Chart

Magnite, Inc (NASD:MGNI) Seasonal Chart

Invesco Senior Income Trust (NYSE:VVR) Seasonal Chart

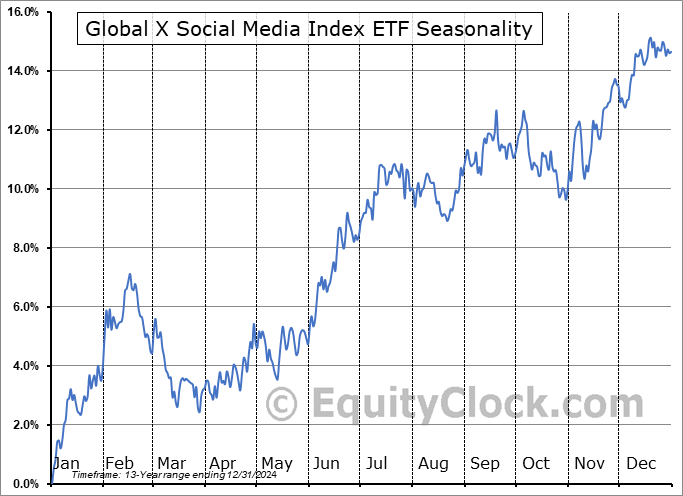

Global X Social Media Index ETF (NASD:SOCL) Seasonal Chart

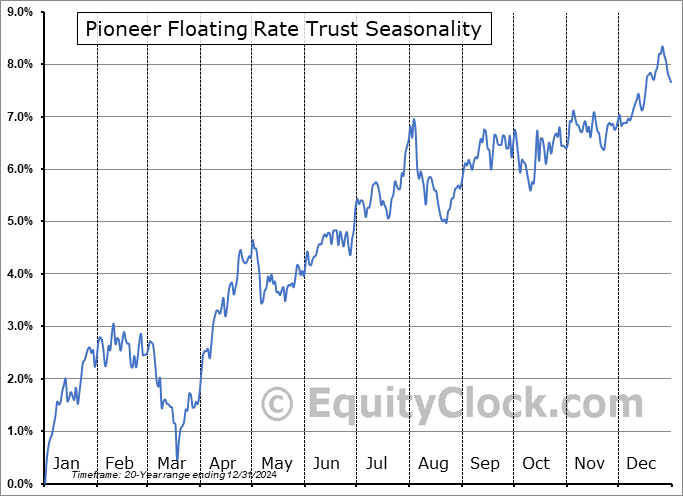

Pioneer Floating Rate Trust (NYSE:PHD) Seasonal Chart

Van Eck Merk Gold Trust (AMEX:OUNZ) Seasonal Chart

PureFunds Video Game Tech ETF (AMEX:GAMR) Seasonal Chart

Evolve Cyber Security ETF (TSE:CYBR.TO) Seasonal Chart

Paramount Global (NASD:PARA) Seasonal Chart

Smart Real Estate Investment Trust (TSE:SRU/UN.TO) Seasonal Chart

A&W Revenue Royalties Income Fund (TSE:AW/UN.TO) Seasonal Chart

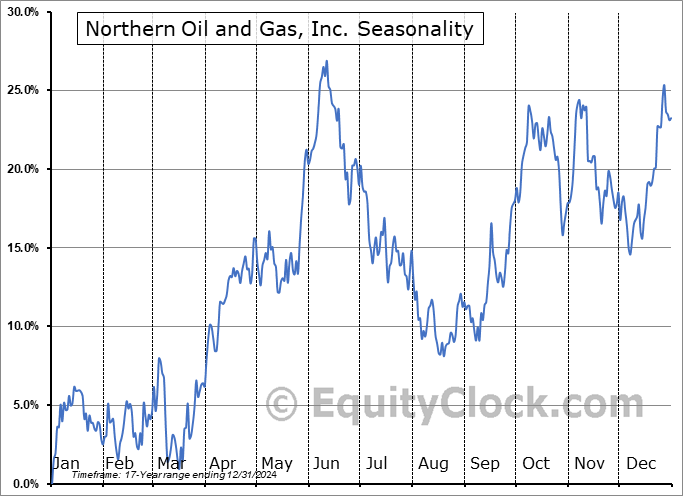

Northern Oil and Gas, Inc. (NYSE:NOG) Seasonal Chart

Lundin Gold Inc. (TSE:LUG.TO) Seasonal Chart

GoGold Resources Inc. (TSE:GGD.TO) Seasonal Chart

Erdene Resource Development Corp. (TSE:ERD.TO) Seasonal Chart

BTB Real Estate Investment Trust (TSE:BTB/UN.TO) Seasonal Chart

First Asset Canadian REIT ETF (TSE:RIT.TO) Seasonal Chart

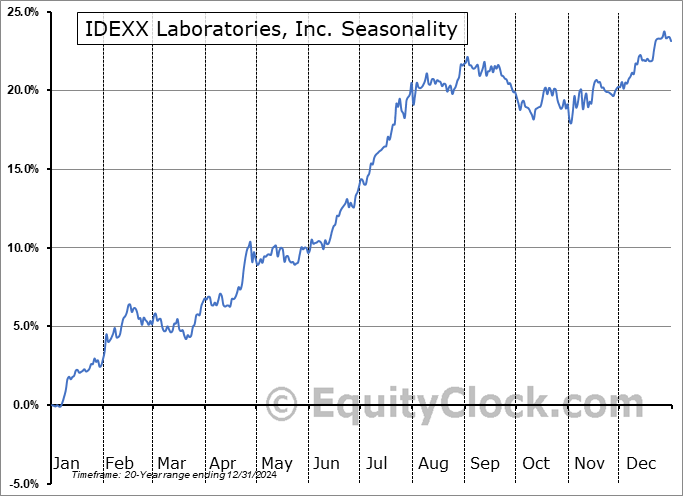

IDEXX Laboratories, Inc. (NASD:IDXX) Seasonal Chart

AltaGas Ltd. (TSE:ALA.TO) Seasonal Chart

Dream Industrial REIT (TSE:DIR/UN.TO) Seasonal Chart

Osisko Mining Inc. (TSE:OSK.TO) Seasonal Chart

iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSE:CDZ.TO) Seasonal Chart

iShares Gold Bullion ETF (TSE:CGL/C.TO) Seasonal Chart

VanEck Vectors Uranium+Nuclear Energy ETF (NYSE:NLR) Seasonal Chart

The Markets

Stocks took a bit of a breather on Thursday as market participants wait for the results of the monthly nonfarm payroll report that is slated to be released on Friday. The S&P 500 Index slipped by just less than two-tenths of one percent after charting a fresh intraday record high during the session. Support continues at the 20-day moving average (5985). The pullback into the last hour of the session caused a break of short-term rising trendline stemming from the November 19th double-bottom low at 5850, however, a trend of higher-highs and higher-lows remains; the 20-hour moving average is presently up-to-bat. On a intermediate-term scale, there remains greater evidence of support than resistance, presenting the desired backdrop for strength that is normally realized in the market at year-end. Major moving averages are all pointed higher and momentum indicators continue to gyrate above their middle lines, providing characteristics of a bullish trend. Our list of candidates in the market to Accumulate and to Avoid remains well positioned to benefit from the strength that is filtering into the market at this seasonally strong time of year, but we will scrutinize whether any changes are required as the price action evolves.

Today, in our Market Outlook to subscribers, we discuss the following:

- Bitcoin, what would cause us to rein in our favourable view to Accumulate exposure, and the seasonality surrounding the cryptocurrency

- The cryptocurrency that may present the better opportunity for portfolios through the months ahead

- VIX falling to levels around the lows of the year, but not yet crossing the threshold to suggest complacency

- Tendencies for the Volatility Index during Post Election years

- Weekly Jobless Claims and the health of the labor market

- A look ahead at what to expect from November’s Nonfarm Payroll report

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 6

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.81.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|