Stock Market Outlook for January 16, 2025

The market is rallying as a result of the suggestion of a calming of inflationary pressures, but we are seeing this burden on consumer and businesses ramping up. We examine ways to take advantage of this shift.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Waste Connections, Inc. (TSE:WCN.TO) Seasonal Chart

Wolverine World Wide Inc. (NYSE:WWW) Seasonal Chart

Arbor Metals Corp. (TSXV:ABR.V) Seasonal Chart

The Markets

Stocks jumped on Wednesday as the market cheered the perception of a calming of inflationary pressures in the economy (at least according to the headline change of CPI ex-food and energy) and reacted positively to earnings from the big banks. The S&P 500 Index gained 1.83%, moving above horizontal support that was broken on Friday at 5850 and retracing back to resistance around the 20-day moving average (5933). The benchmark remains below short-term declining trendline resistance at 5975, a hurdle that the benchmark has persisted below over the past month. While Wednesday’s move seems to diminish the threat that the head-and shoulders pattern on the chart was portraying previous, it has not been taken off the table. Horizontal support at 5850 presents the neckline to the topping pattern, a bearish setup that proposes a downside target of 5670. Superseding any patterns that can be picked out is just the mere appearance that resistance, such as around the 20-day moving average, is starting to have a greater influence than support. Reason to conclude the shift of trend has been provided. We continue to scrutinize the potential impact of this evolving shift on our list of candidates in the market to Accumulate and to Avoid and we are expecting that our list will show more of a neutral appearance through the weeks ahead as segments that were previously noted as Accumulate candidates fall off and areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Consumer Price Index (CPI) and the investment implications within

- Commodity prices breaking out

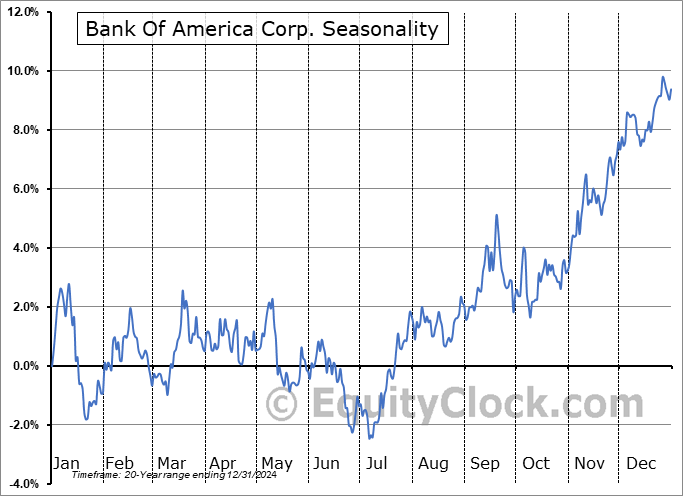

- Banks

- Energy demand and the break of declining trendline resistance for the price of Oil

- Oil & Gas Exploration & Production stocks

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 16

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.84.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|