Stock Market Outlook for January 27, 2025

Momentum in the market is waning as the technology sector loses its grip on investor portfolios.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Aon Corp. (NYSE:AON) Seasonal Chart

Idex Corp. (NYSE:IEX) Seasonal Chart

Greenbrier Cos, Inc. (NYSE:GBX) Seasonal Chart

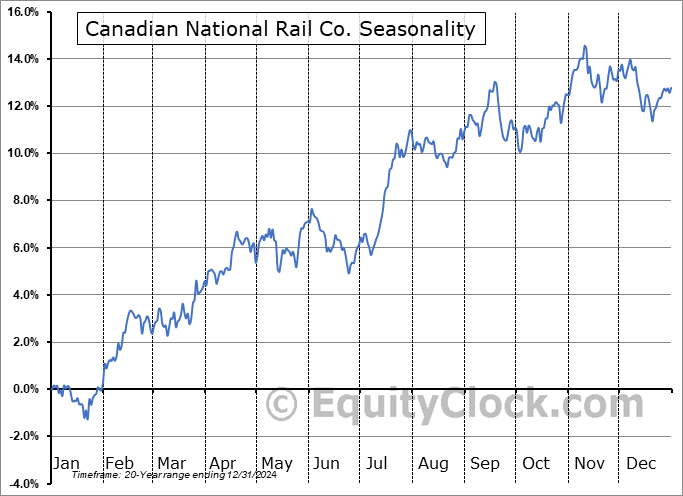

Canadian National Rail Co. (NYSE:CNI) Seasonal Chart

Galiano Gold Inc. (AMEX:GAU) Seasonal Chart

NextEra Energy Inc. (NYSE:NEE) Seasonal Chart

UFP Technologies, Inc. (NASD:UFPT) Seasonal Chart

Gladstone Land Corp. (NASD:LAND) Seasonal Chart

Andlauer Healthcare Group Inc. (TSE:AND.TO) Seasonal Chart

Lattice Semiconductor Corp. (NASD:LSCC) Seasonal Chart

Corpay, Inc. (NYSE:CPAY) Seasonal Chart

The Markets

Stocks traded off of the all-time highs that were recorded in the prior session to end the day lower on Friday. The S&P 500 Index slipped by just less than three-tenths of one percent, holding above the previous all-time high charted earlier in December. Levels of resistance have been taken out, including short-term declining trendline resistance around 5975, that capped the benchmark over the past month. Momentum indicators are moving back above their middle lines, attempting to shake off some of the short-term bearish readings that were filtering into the market following the pullback in stocks between early December and the middle of January. Various metrics, such as the put-call ratio, are highlighting the emergence of complacency, which skews the risk-reward of the market in the near-term given the bullish bet that has been adopted. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we are still expecting that our list will show more of a neutral appearance through the weeks ahead as segments that were previously noted as Accumulate candidates fall off (eg. Technology), potentially replaced by some value segments of the market, and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The sustainability of the rising trend of the market about to be put to the test

- Technology weighing on the momentum of the market at this seasonally weaker time of year for sector performance

- China Technology stocks set to steal the baton from US counterparts in the early days of the Trump presidency?

- Investors still showing a risk-taking mentality

- US Existing Home Sales

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.77.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|