Stock Market Outlook for February 14, 2025

Another report on inflationary pressures in the economy highlighting the need for commodity exposure in portfolios at this seasonally strong time of year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

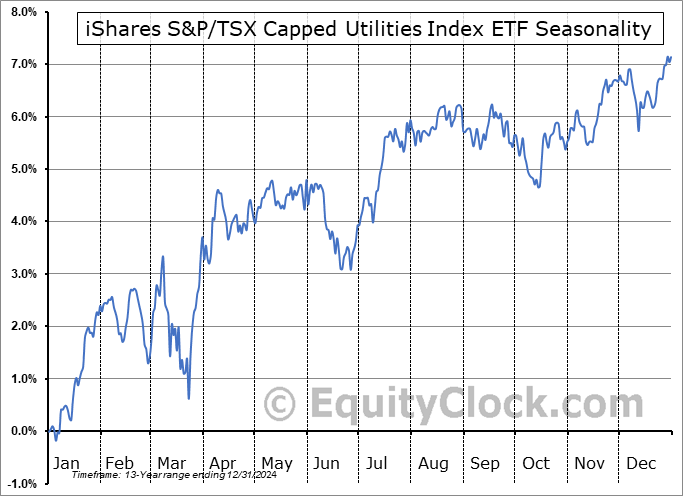

iShares S&P/TSX Capped Utilities Index ETF (TSE:XUT.TO) Seasonal Chart

TXNM Energy, Inc. (NYSE:TXNM) Seasonal Chart

Invesco S&P 500 Equal Weight Utilities ETF (NYSE:RSPU) Seasonal Chart

Vanguard Consumer Staples ETF (NYSE:VDC) Seasonal Chart

Invesco S&P 500 Low Volatility ETF (NYSE:SPLV) Seasonal Chart

EQT Corp. (NYSE:EQT) Seasonal Chart

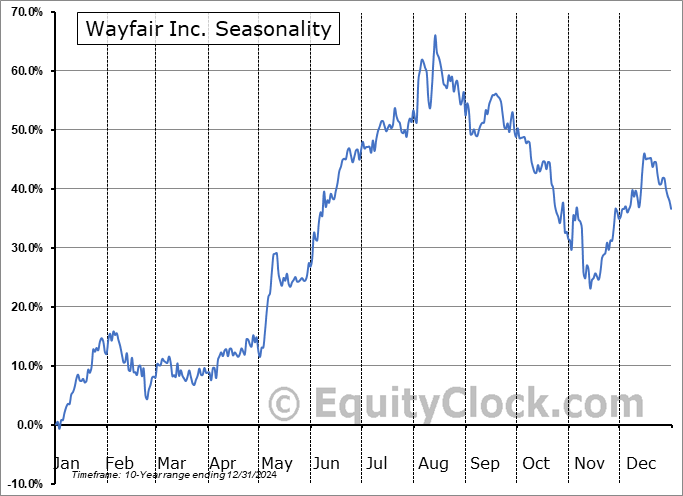

Wayfair Inc. (NYSE:W) Seasonal Chart

Canadian Tire Corp, Ltd. (TSE:CTC/A.TO) Seasonal Chart

Telus Corp. (NYSE:TU) Seasonal Chart

Forrester Research, Inc. (NASD:FORR) Seasonal Chart

Limoneira Co. (NASD:LMNR) Seasonal Chart

Northwest Natural Gas (NYSE:NWN) Seasonal Chart

Alliant Energy Corp. (NASD:LNT) Seasonal Chart

Dollarama Inc. (TSE:DOL.TO) Seasonal Chart

Merck & Co., Inc. (NYSE:MRK) Seasonal Chart

Kimberly Clark Corp. (NYSE:KMB) Seasonal Chart

The Markets

Stocks closed higher on Thursday as traders found comfort in the fact that Trump’s reciprocal tariff announcement was not an immediate decree, but rather merely a memorandum examine the implementation of countervailing taxes on goods coming into the country in order to level the playing field on international trade. The S&P 500 Index jumped by just over one percent, moving marginally above the 6100 hurdle that has acted as a cap to upside momentum in the past couple of months. The benchmark is managing to remain resilient above 20 and 50-day moving averages, despite the apparent loss of excitement to buy around present heights. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- Tendencies for stocks in the back half of February

- US Producer Price Index (PPI)

- The breakout of inflation expectations

- Commodity prices setup well to move higher during their period of seasonal strength

- The fundamentals behind the seasonal trade in the energy sector

- The third largest drawdown in Natural Gas stockpiles through the first six weeks of the year in the past decade

- Weekly jobless claims and the health of the labor market

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 14

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended close to neutral at 0.95.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|