Stock Market Outlook for February 19, 2025

Commodity exposure continues to attract demand as traders seek to mitigate the inflationary impact that tariffs are likely to impose.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

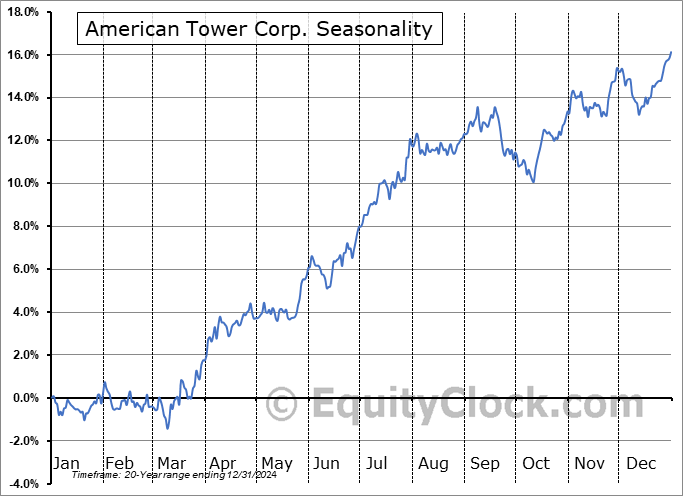

American Tower Corp. (NYSE:AMT) Seasonal Chart

Essex Property Trust, Inc. (NYSE:ESS) Seasonal Chart

Digital Realty Trust, Inc. (NYSE:DLR) Seasonal Chart

Douglas Emmett Inc. (NYSE:DEI) Seasonal Chart

Aemetis, Inc. (NASD:AMTX) Seasonal Chart

The Markets

Stocks closed higher on Tuesday as traders latched on to commodity sensitive names in the material and energy sectors amidst an ongoing bet that commodity prices will continue to rise through the months ahead. The S&P 500 Index was up by nearly a quarter of one percent, closing at a fresh record high and maintaining levels slightly above the 6100 hurdle that acted as a cap to upside momentum in the past couple of months. The benchmark is managing to remain resilient above 20 and 50-day moving averages, despite the apparent loss of excitement to buy around present heights. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- The stall in the cryptocurrency market (Bitcoin)

- Our weekly chart books update, along with our list of all segments of the market to either Accumulate or Avoid

- Other Notes

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 19

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.76.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|